Investment funds traded on stock exchanges are already a common and well-understood concept across the stock investment market. So, what happens when the crypto space is bridged into traditional finance? The answer is, of course, a Crypto ETF.

Owning cryptocurrencies as an individual can be a non-trivial journey, as usability and, especially, secure custody, can still be subject to misunderstandings. In this sense, Crypto ETFs allow investors to gain exposure to these assets without the need to own them directly, through regulated entities and traditional exchanges they already know.

Types of ETFs

The underlying logic of how an investment vehicle can track the price of crypto assets can vary. In this article, two of the most relevant methods will be discussed: Futures and Spot.

Futures

A futures-based crypto ETF doesn’t track the asset itself but rather its price. This is done by investing in contract agreements to buy and sell the underlying assets at a specific price. A Bitcoin futures contract, for example, is an agreement to buy or sell BTC at a predefined price at a later date.

Futures ETFs have existed for a while in the market, with a vast number of companies offering this service across different countries.

Spot

On the other hand, a spot crypto ETF offers direct exposure to the token, holding custody of the cryptocurrency itself. Essentially, the spot price of an asset is the exact price at which it is being traded in the market.

In terms of potential demand and consequent price increases, spot ETFs represent a significant milestone for the development of the crypto ecosystem.

Features

- Price Tracking: Spot ETFs are highly regarded as superior in this matter as they hold the assets under custody, directly tracking the price. For futures, ETF prices may diverge based on the prevailing settlement of futures traders. If too many people expect the asset to increase in price, the value could be higher than the actual asset.

- No Self-Custody: In both cases, investors won’t need to buy crypto directly, achieving exposure to the asset without extra complexities.

- Regulation: Crypto ETFs are built on top of regulated frameworks, allowing investors to use platforms they are already familiar with.

- Fees: ETFs can be costly compared to holding crypto directly. This happens because fund managers may charge fees to operate.

- Ownership: As mentioned, Crypto ETFs only provide exposure to cryptocurrencies. While many institutional investors might find that appealing, it goes against the self-custody concepts many crypto natives defend.

Crypto Classification

There is much debate among legislators on whether the correct classification of crypto assets should be classified as securities or commodities. While this difference is clear when applied to traditional assets like gold, stocks, or bonds, digital assets have been a topic of ongoing discussion between these two types of assets. Although uncertain and subject to controversy, this classification can be definitive on how they are regulated and rules that must be followed.

Commodities

Commodities are basic goods that can be traded and exchanged. If classified as such, crypto may face less regulatory burden and enhanced flexibility. For those reasons, crypto industry executives argue that cryptocurrencies should be considered commodities. Some of the arguments sustaining this point of view is the fact that this type of asset is often used as a store of value and traded for speculative purposes, mirroring commodities.

Moreover, investing in securities is usually attached to relying on a common enterprise and profiting from third parties. Given the decentralized nature of many cryptocurrencies, where no single point can be definitive for the network, their commodity classification narrative can be strengthened.

Securities

Securities are typically represented by stocks and bonds. Crypto classified as securities will be treated as an investment contract and may face an extra layer of regulatory compliance over their functioning. Some key aspects of the blockchain ecosystem might as well advocate for a closer definition of a security. A clear example of that is the common practice of ICO’s, where investors can participate in early crypto projects and earn their profits. Usually those projects are governed by an institution or company, creating a framework that is close to traditional enterprises. Another instance of this approximation is crypto lending projects, which offer credit in exchange for fees, closely mirroring the mechanism of bonds.

Howey Test

The Howey test provided by the Supreme Court has four criteria for determining whether an asset constitutes an investment contract and security.

- Investment of Money: There is a financial investment by individuals or entities.

- Expectation of Profits: Investors expect to earn returns on their investments.

- Common Enterprise: The investment is part of a collective pooling of assets, where the fortunes of investors are linked.

- Efforts of Others: The success or profitability of the investment primarily depends on the efforts of a third party or promoter.

This framework has been important for assessing various assets in the blockchain ecosystem. However, projects in the blockchain space can have unique structures and operational models, which may not neatly fit into the Howey Test criteria.

For example, while some blockchain projects might involve straightforward token investments with clear profit expectations and central management, others, particularly those in decentralized finance (DeFi) or decentralized autonomous organizations (DAOs), operate in a more distributed manner where control and profits are less centralized. This diversity requires nuanced regulatory approaches to accurately reflect the unique characteristics of each project.

Bitcoin ETFs Listing

On January 10, 2024, the SEC approved 11 new spot bitcoin ETFs, marking a new era of crypto institutional adoption. Due to its highly decentralized nature, store of value nature and interchangeability, Bitcoin is the only crypto widely described as a commodity.

Impact on price

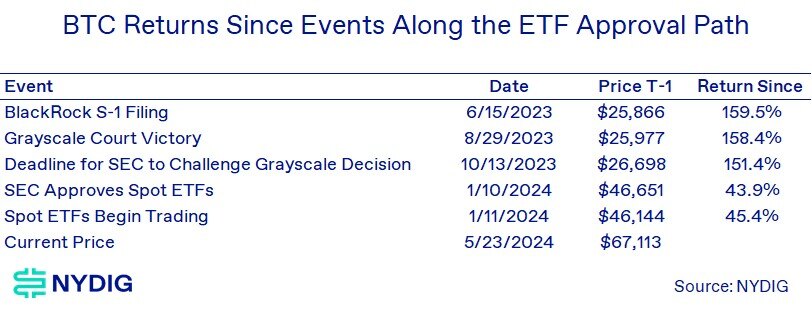

Even if a Spot ETF does not affect the price directly, as mentioned, its adoption can by consequence increase the demand for BTC. Notably, since its inception, bitcoin has started a rally, as e3videnciated by the NYDIG report.

Ethereum ETFs Approval

On 23 May 2024, in a turn of events, Ethereum ETFs were approved in the United States. Until it is available for trading, though, some regulatory steps are still to be fulfilled.

The classification of Ethereum (ETH) by the SEC remains a contentious issue. Historically, the SEC had indicated that Ethereum, like Bitcoin, was not considered a security. However, recent actions and statements suggest that this stance might be changing, especially after Ethereum’s transition to a proof-of-stake model.

The May 24 approvals followed several months of pessimism regarding the prospect that the funds would receive approval, with many onlookers anticipating that the SEC would try to classify Ether as a security asset.

Impact on price

The first relevant topic to be considered is that, since the approval of ETH Futures ETHs, they have underperformed the popularity of Bitcoin ETFs by a lot.

This behaviour can be due to many reasons. ETH, for example, is much appreciated by its utility, which is used to build and create smart contracts. An ETF goes against this vision, as it limits the usage of the token to its investment purpose.

Regardless, using spot bitcoin ETF inflows as a benchmark, NYDIG presents some potential demand for ETH ETFs.

Final Considerations

The introduction of Crypto ETFs marks a significant step in bridging the gap between traditional finance and the burgeoning cryptocurrency market. By providing a regulated and familiar platform for investors, these ETFs offer a more accessible and secure way to gain exposure to digital assets without the complexities of direct ownership.

Understanding the different types of Crypto ETFs, such as futures and spot ETFs, is crucial for investors to make informed decisions. While futures ETFs track the price of the asset through contract agreements, spot ETFs hold the actual cryptocurrency, providing direct exposure to its market value. Each type has its advantages and potential drawbacks, including considerations around price tracking, custody, regulation, fees, and ownership.

The ongoing debate around the classification of cryptocurrencies as either commodities or securities further complicates the regulatory landscape. This classification has profound implications for how these assets are regulated and traded.

The approval of spot Bitcoin ETFs by the SEC has set a precedent and could significantly influence the market dynamics and regulatory treatment of other cryptocurrencies, such as Ethereum. As the regulatory environment continues to evolve, investors and market participants must stay informed about these developments and their potential impacts on the crypto ecosystem.

Article Researched and Written by :

Marcos Batalheiro

Marcos’ LinkedIn – https://www.linkedin.com/in/marcosposse/

References

https://nydig.com/research/seismic-shifts-in-the-regulatory-and-legal-backdrop-for-crypto

https://www.linkedin.com/pulse/sec-vs-crypto-exchanges-battle-asset-classification-giovanni-populo/

https://www.etf.com/sections/etf-basics/spot-bitcoin-etfs-vs-bitcoin-futures-etfs

https://www.ledger.com/academy/topics/economics-and-regulation/bitcoin-spot-futures-etf