Introduction

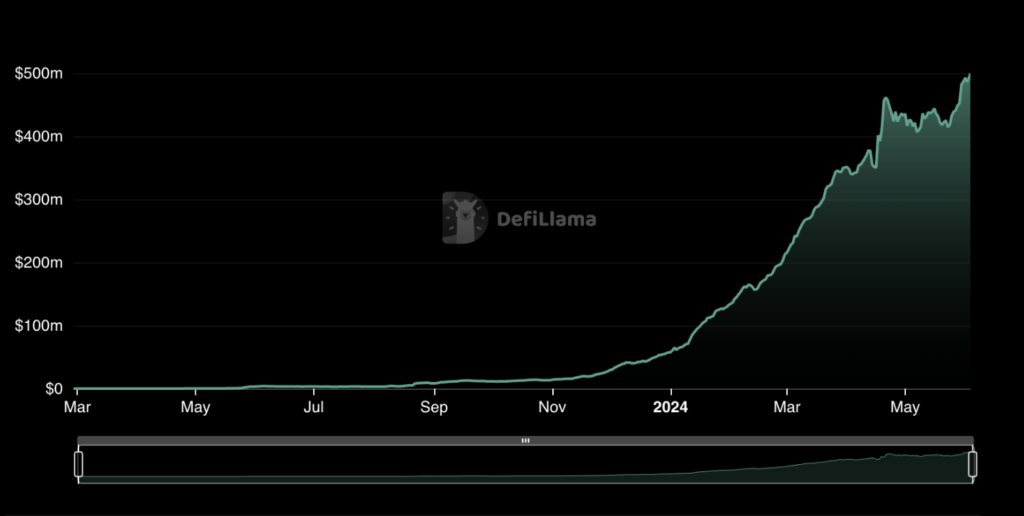

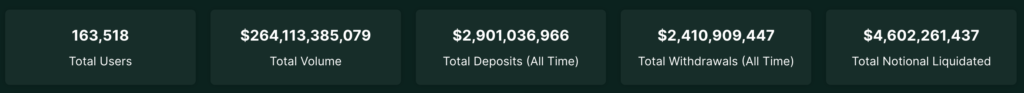

In just a year, Hyperliquid, has achieved over $54 billion in total trading volume and a daily trading volume exceeding $870 million. This decentralized perpetual futures exchange, is attracting over 1,000 new users daily. But how? what sets Hyperliquid apart?

The short answer is this. It offers advanced trading features like up to 50x leverage, access to over 20 underlying assets, and innovative copy trading capabilities, making it accessible to both professionals and newcomers. However, Hyperliquid’s true innovation lies in its custom-built Layer 1 blockchain and HyperBFT consensus algorithm, allowing for a wide range of permissionless financial applications.

By building its order book fully on-chain, Hyperliquid is poised to rival industry giants. Most people just consider it as a Dapp ,because of its DEX, but do not overlook the fact that it is actually a L1 blockchain. As a decentralized exchange built from the ground up, it shares similarities with Binance, but its journey is not without challenges. Greater transparency about its tokenomics and investor backing is crucial for building long-term trust. As Hyperliquid expands, it remains focused on maintaining full decentralization while ensuring efficient and secure trading. Let’s dive into Hyperliquid’s stellar performance, its potential to reshape decentralized trading, and its future prospects.

P.s you can skip this section if you are familiar with HLP and their HIP tokens.

HLP Vaults: Democratizing Liquidity Provision for All

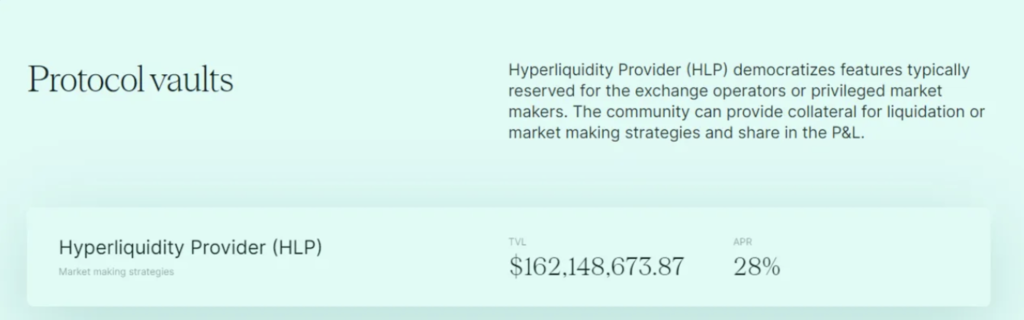

Hyperliquid’s main vision is to enhance user experience and community engagement and the heart of this initiative are the Hyperliquid Provider (HLP) Vaults, a feature that opens up liquidity provision to everyone.

Vault Mechanics

The HLP Vaults are community-owned, focusing on market making and liquidations to earn a share of the trading fees generated on the platform. Hyperliquid allows users to deposit their assets into these vaults and by doing so democratizes access to liquidity provision, turning it into a collective effort. Almost like crowdsourcing. Every user can track their positions and the vault’s trades on-chain, maintaining full transparency & trust within the community and most importantly achieving insane speeds.

Vault Creation and depositing

On Hyperliquid, users can create their own vaults too. The idea is to share their trading strategies with the community and other can put money in your strategy. To get started, simply choose a name and description for your vault, deposit at least 100 USDC, and begin managing your vault. To ensure commitment, vault creators must maintain a 5% stake in their vault and earn a 10% profit share for their management efforts.

Depositing into an HLP vault offers numerous benefits. You’ll earn a share of the vault’s profits (or losses) based on your stake, aligning incentives and fostering a collaborative environment. By supporting vault leaders, you can gain exposure to varied trading strategies, potentially enhancing your returns. For example, if you deposit 100 USDC into a vault with 900 USDC, you’ll own a 10% stake. If the vault grows to 2,000 USDC, you can withdraw 200 USDC (your 10% share) minus a 10% profit share to the vault leader, resulting in 190 USDC. Profits earned by the vault are shared with depositors based on their stake, ensuring that everyone benefits proportionally from the platform’s success. The annual percentage rate for depositors can vary from 0% to 15%, depending on the vault’s performance, offering potentially lucrative returns.

HLP Vaults represent Hyperliquid’s commitment to a user-centric approach in DeFi. By being transparent, inclusive, and rewarding to the community, Hyperliquid is creating a loyal user base. With its token and points system, Hyperliquid is poised to create a lot of buy pressure for its token, making it a promising investment opportunity.

Fee Structure

The HLP vault operates with a clear and straightforward fee structure. A 2.5 basis points (bps) fee is charged on trades, while makers receive a 0.2 bps rebate to incentivize liquidity provision. Referrers earn 10% of their referees’ taker fees, and the remaining fees are allocated to the HLP vault, ensuring continuous growth and reward for all participants. Yes, so basically, profits is not their main goal right now the fee is cheap and they give users the ability to create their own vaults as well.

Hyperliquid Points Program : rewards and value

Hyperliquid’s points program is designed to reward active users and affiliates for their participation and loyalty. Here’s how it works:

- From November 1, 2023, to May 1, 2024, 1,000,000 points were distributed weekly, with a bonus for early adopters.

- Starting May 29, 2024, 700,000 points are distributed weekly, with a multiplier for activities from May 1-28, 2024.

- Affiliates earn a 1:5 points match, and distributions are made every Friday.

Key Features

- Dynamic program with regular updates to keep it fair and engaging

- Rewards both activity and loyalty

- Holding $PURR, Hyperliquid’s native memecoin, increases points and airdrops of other spot tokens

- Airdrop strategy provides additional rewards to loyal holders, driving demand and increasing ecosystem value

Points Value

According to Messari, HL points could be worthmore that what it is curre . With a potential fully diluted valuation (FDV) of $3 billion, one point could be worth up to $23.48, according to Messari’s research. The market may be undervaluing the points’ value due to low airdrop expectations and limited information on its tokenomics.

HIP-1 Token Standard: Enhancing Trading Experience

After its memecoin $PURR, Hyperliquid’s next HIP-1 token standard plans to introduce a range of features to enhance the trading experience, including a capped supply with an inflationary model. This ensure scarcity and drive up token value over time (so basically users would be incentivised to hold). It utilizes unique on-chain spot order books for real-time trading, offering a decentralized alternative to traditional exchanges and automated market makers (AMMs). HIP-1 also features flexible deployment parameters, allowing developers to customize tokens with specific names, decimal configurations, and supply limits, catering to diverse applications within the Hyperliquid ecosystem.

Genesis tokens are allocated to existing anchor token holders, incentivizing long-term investment and community growth (again loyal tokenholder ftw). Hyperliquid uses a Dutch auction format to manage gas costs, promoting early participation and efficient resource allocation. Additionally, HIP-1 features a daily dust management process, deflationary fee-burning mechanism, and Hyperliquidity features for smoother integrations with stablecoins like USDC. These elements aim to enhance liquidity, efficiency, and collectively position HIP-1 as a versatile option for developers and users. But, that’s just my opinion.

HIP-2 Token Standard: Decentralized Liquidity Provision

HIP-2 focuses on efficient order sizes, optimizing liquidity utilization by targeting both full and partial orders based on available balance. Unlike HIP-1, which focuses on token customization and genesis token distribution, HIP-2 emphasizes real-time price discovery and decentralized liquidity provision, ensuring resilience against manipulation and external control. HIP-2’s parameter flexibility allows users to customize their trading strategies, and its automated updates reduce the burden on liquidity providers. Additionally, HIP-2’s on-chain order book integration supports complex trading strategies while simplifying user interactions.

The key differences between HIP-1 and HIP-2 are:

- HIP-1 focuses on token customization and genesis token distribution, while HIP-2 focuses on decentralized liquidity provision and real-time price discovery.

- HIP-1 is suitable for tokens with established prices, while HIP-2 is designed for tokens in early phases of price discovery.

- HIP-1 relies on external operators for liquidity provision, while HIP-2 democratizes liquidity, allowing all users to participate.

HyperBFT

HyperBFT is a consensus algorithm designed by the Hyperliquid team to achieve high-throughput performance. It’s built on the Hotstuff protocol and is capable of supporting up to 2 million orders per second, with a realistic target of 200k orders/second. HyperBFT is based on Byzantine Fault Tolerance (BFT), ensuring the network remains operational even if a portion of it fails or becomes untrustworthy.

How HyperBFT Optimizes Performance

HyperBFT’s performance is driven by two key features: Optimistic Execution and Optimistic Responsiveness. Optimistic Execution allows transactions to be executed before block finalization, reducing blocktime. Optimistic Responsiveness enables consensus to scale with network conditions, producing blocks quickly as soon as a quorum of validators is reached. These features enable HyperBFT to achieve a significant increase in throughput, making it suitable for demanding applications like on-chain perps exchanges.

Hyperliquid’s competition

Hyperliquid and dYdX both focus on decentralized perpetual trading, but unlike dYdX’s off-chain matching engine, Hyperliquid’s high-performance Layer 1 blockchain is optimized for high-frequency trading (HFT), allowing for real-time price discovery and efficient trading. With its trading volumes making up roughly 6% of Binance’s in June, Hyperliquid shows significant market presence.

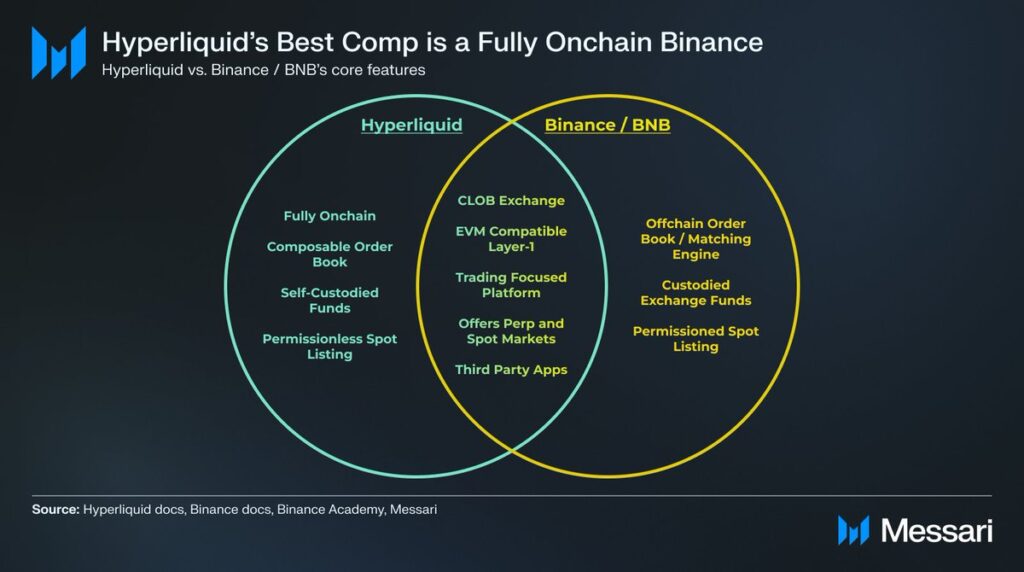

In comparison to Binance, Hyperliquid aims to be a fully on-chain and permissionless version of the leading centralized exchange. While Binance operates within a centralized infrastructure, Hyperliquid leverages its custom-built consensus algorithm, HyperBFT, for secure and efficient trading. The platform’s upcoming EVM compatibility and ecosystem development efforts, along with interest from third-party apps like Rage Trade and HyperlendX, indicate Hyperliquid’s potential to become a decentralized hub offering diverse DeFi applications.

Hyperliquid mirrors Binance’s ecosystem by offering a diverse range of DeFi applications, including spot trading, perpetual futures, and lending protocols, creating a comprehensive ecosystem for users. With its upcoming EVM compatibility, Hyperliquid will enable the deployment of various DeFi apps, similar to Binance’s BSC Chain. The platform is also attracting interest from third-party apps, like Rage Trade and HyperlendX, and is working to achieve liquidity and volume levels comparable to Binance. Additionally, the protocol is fostering a strong community through its Discord channel and other engagement initiatives, similar to Binance’s large and active user base. Hyperliquid, at the forefront of innovation, is creating a decentralized and permissionless alternative to Binance’s centralized exchange model.

Comparing to other competitors:

| Feature | Hyperliquid | GMX | Vertex Protocol | AEVO |

|---|---|---|---|---|

| TVL | $153 million | $600 million | $43 million | $52 million |

| Daily Trading Volume | $870 million | $7 billion | $182 million | $42 million |

| Trading Pairs | 109 | 12 | 37 | 56 |

| Order Type | On-chain order book | AMM (off-chain) | AMM (off-chain) | Off-chain order book |

| Launch Date | June 2023 | Fall 2021 | Spring 2023 | Summer 2023 |

| Number of Users | 64,500 | 87,500 | N/A | N/A |

| Special Features | Copy trading, fast transactions | Spot trading, liquidity pools | N/A | OTC options |

Performance

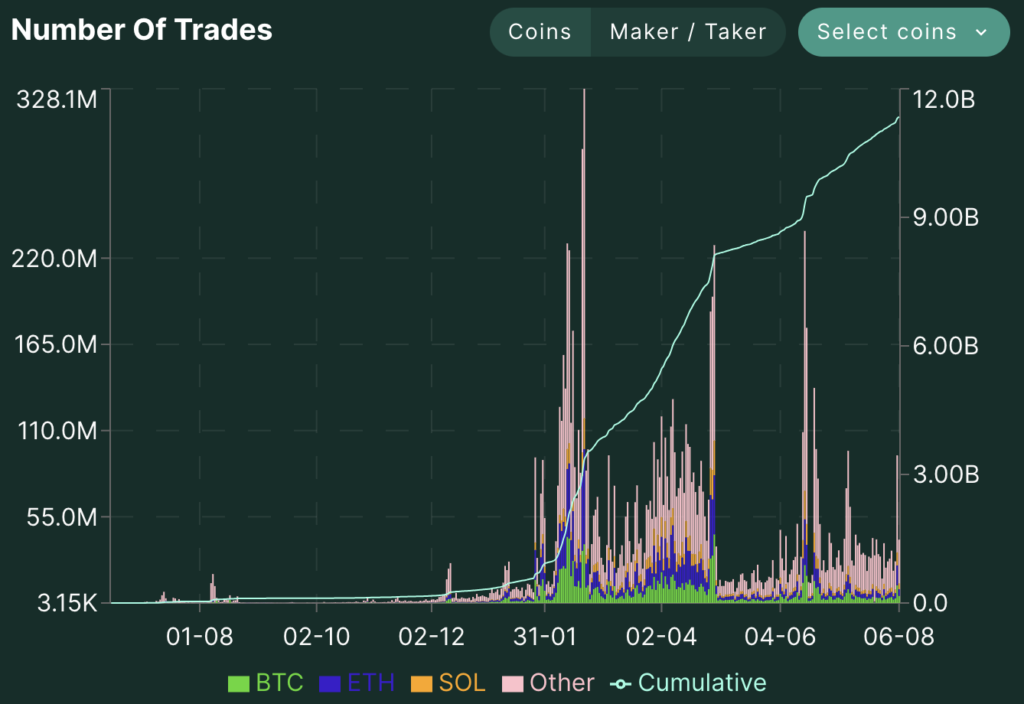

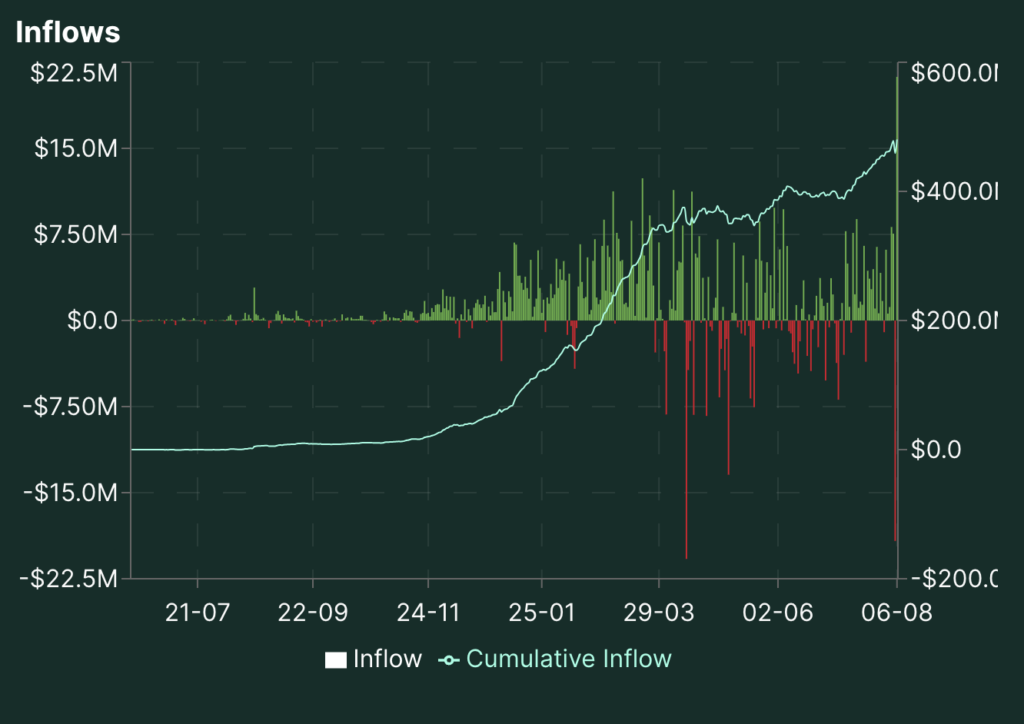

Hyperliquid’s performance metrics reveal a mixed picture. On one hand, the protocol has achieved an impressive cumulative trade volume of $11.35 billion, with a total of 40.1 million trades. However, the average trades per user stand at 245, which raises concerns about the authenticity of user activity. On the other hand, the protocol’s ability to attract new users, with each one bringing in an average of $2,956 (based on a cumulative inflow of $480.4 m), is a promising sign for investors. Overall, Hyperliquid’s performance suggests a need for further scrutiny to separate genuine user engagement from potential manipulation, while also acknowledging the protocol’s ability to generate significant revenue.

Risks

Navigating Hyperliquid comes with specific challenges. Smart Contract Risk is paramount; the onchain Perp DEX relies on the security of Arbitrum bridge smart contracts, and any bugs could result in loss of user funds. L1 Risk is also significant, as Hyperliquid’s custom L1 hasn’t undergone the extensive testing of more established networks like Ethereum, making it vulnerable to potential downtime from consensus issues. Market Liquidity Risk poses another concern; as a relatively new protocol, low liquidity in the early stages can cause significant price slippage and potential trader losses. Lastly, Oracle Manipulation Risk threatens the stability of the system, as compromised or manipulated price oracles by validators could lead to unfair liquidations and affect the mark price.

For the Future

The perp DEX segment is poised for growth due to regulatory challenges faced by CEXs and increased demand during bull cycles, positioning Hyperliquid to benefit from this rising tide. Hyperliquid’s plans on deploying their native EVM and fully decentralizing the network. They are also focused on maintaining high TPS and low latency with HyperBFT consensus, enhancing financial primitives such as on-chain spot and perp order books, vaults, oracles, and automated liquidity. Additionally, a new fee tier system, effective March 10th, will introduce taker fees ranging from 0.035% to 0.019%, making the platform even more attractive to traders.

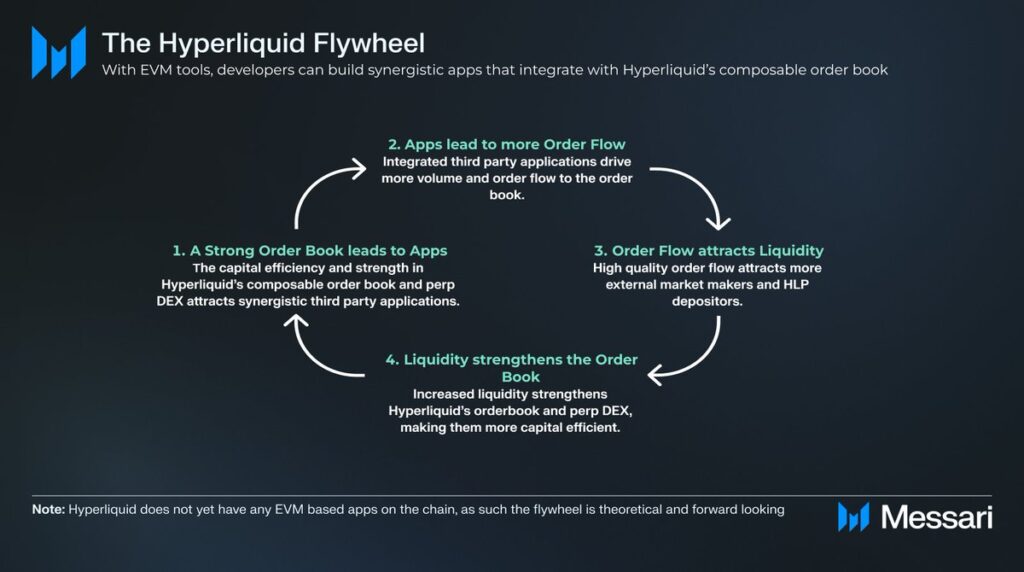

The Hyperliquid flywheel illustrates a self-reinforcing cycle of growth driven by EVM compatibility and a robust trading infrastructure. A strong, composable order book attracts third-party developers to build synergistic applications, increasing order flow. This high-quality order flow draws more external market makers and liquidity providers, enhancing liquidity and making the trading environment more efficient. As liquidity strengthens the order book, it further attracts developers and users, perpetuating the cycle. The integration of EVM tools lowers the barrier for developers, fostering innovation and ecosystem growth, which continuously fuels the flywheel. As Hyperliquid continues to evolve, with each turn of the flywheel, it is surely a protocol to keep a watch on.

Article Researched and Written by :

Amman Kamani

Amman’s LinkedIn – https://www.linkedin.com/in/ammankamani/