Introduction

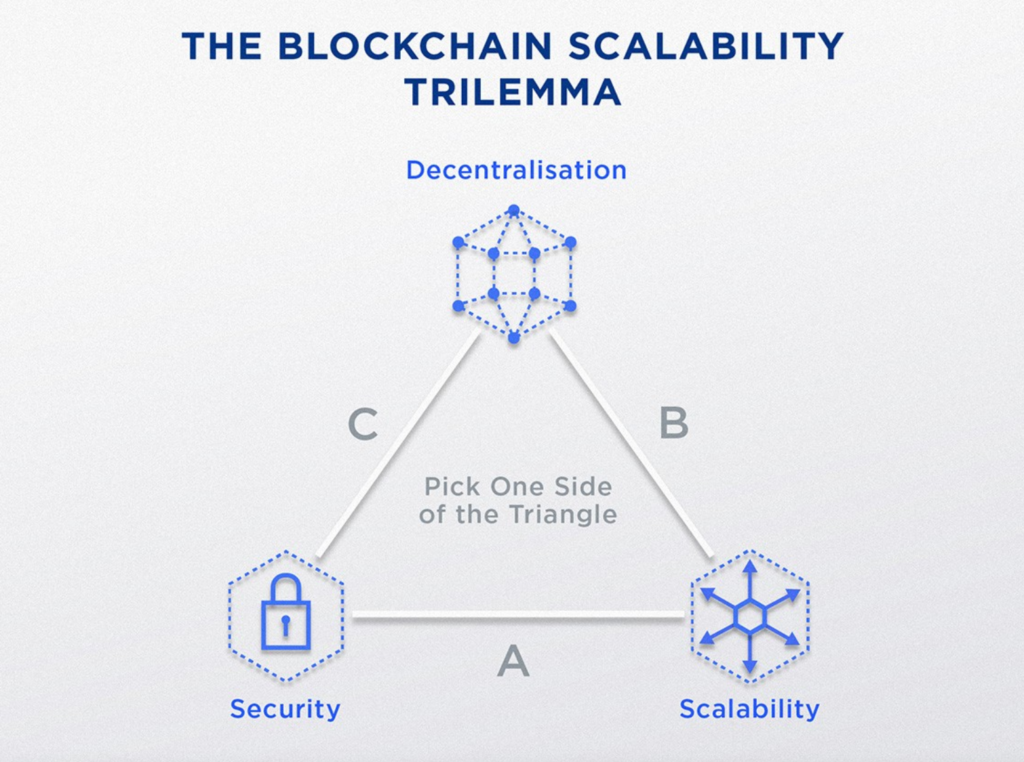

Imagine being stuck between a rock and a hard place, a catch 22 situation if you will, and you’d be welcomed by the blockchain trilemma. A trilemma where security, decentralization, and scalability are constantly at odds. This frustrating tradeoff has long hindered the mass adoption of blockchain technology – until Ethereum’s L2 scaling solutions. So, why do we care?

Decentralization and security naturally go hand in hand, but when you add scalability to the mix, the data becomes heavier with slower processing. For blockchain technology to achieve mass adoption, scalability is crucial. We see this in the real world as well, for a network to compete with traditional platforms in convenience, transaction speed, and throughput it needs to scale up.

But what exactly is L2, and how does it address the trilemma? Who are the key players driving this innovation, and what impact does it have on Ethereum’s core layer? Let’s dive in and explore the future of blockchain scalability.

Layer 2 and the use of rollups

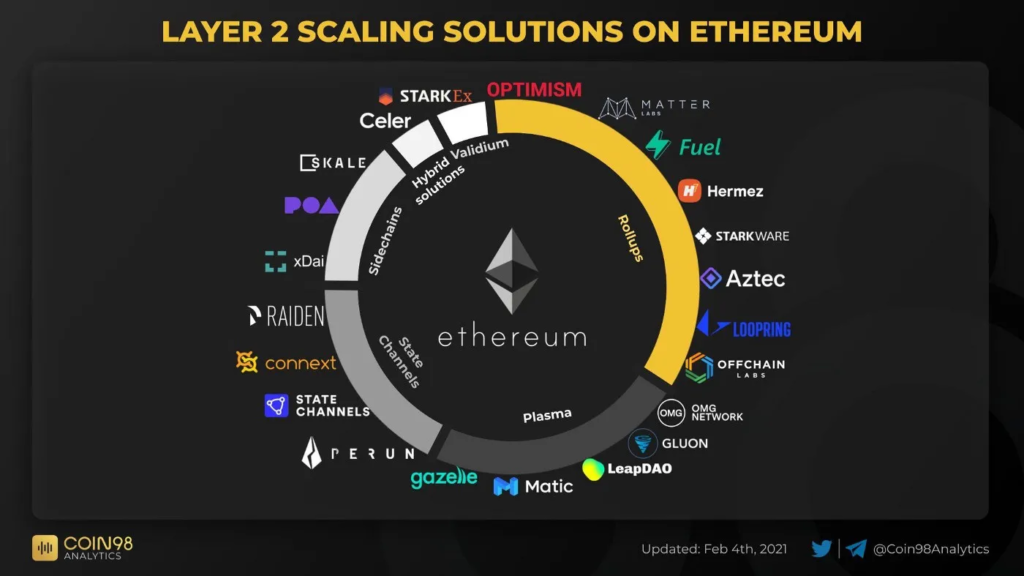

Layer 2 (L2) is a collective term used to describe a specific set of Ethereum scaling solutions. A separate blockchain that extends Ethereum all the while inheriting its security. (Basically they can have their cake and eat it too.)

Now, if you were to delve deeper you would find Ethereum’s main network, Layer 1. Ethereum blockchain’s base layer is where all transactions are settled. It is highly secure, with a network of node operators validating transactions. Thoroughly battle-tested, decentralised, and arguably the most secure blockchain outside of Bitcoin.

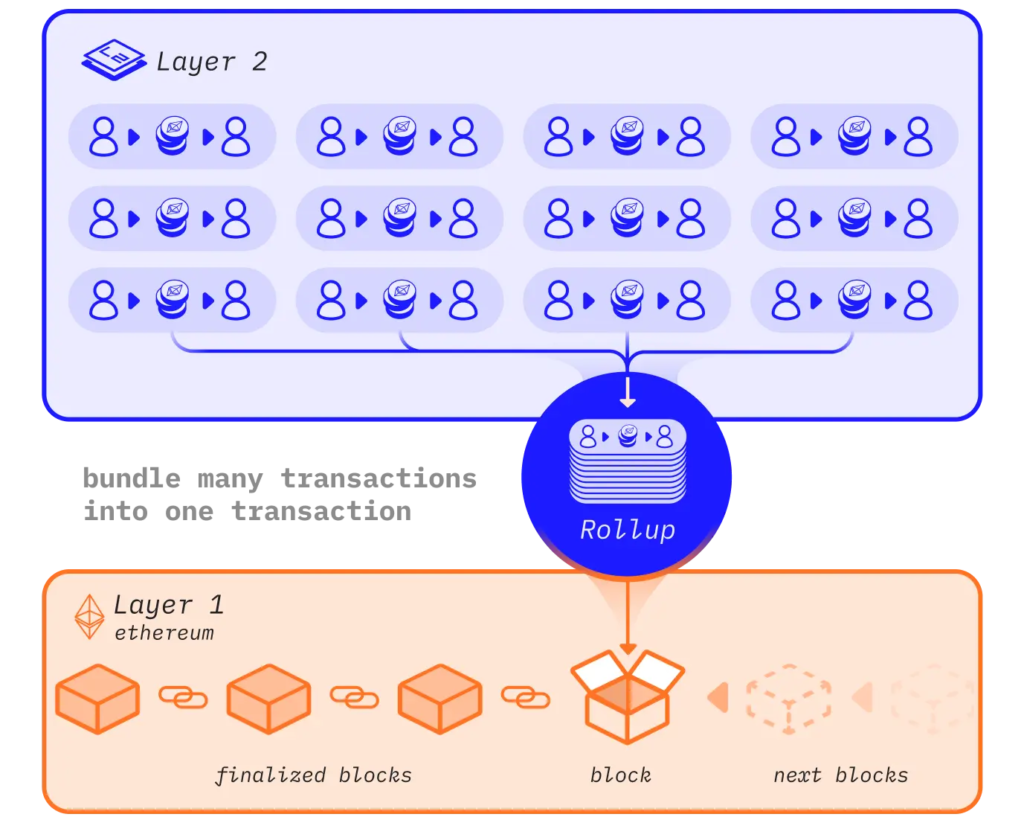

L2 rollups builds on top of this. Think of rollups as using a free way, freeing up the load of the network, a better choice than having a traffic jam in on L1.

Rollups are a new-age layer-2 scaling solutions that bundle multiple transactions and process them off-chain. Once processed, the transaction data gets published on Layer-1. As a result, rollup Layer2 networks perform the role of load balancing, thereby improving overall scalability and speed for better performance.(Fig.2 makes it a lot easier)

Layer-2 rollup networks can be general and application specific. Dapps have the freedom to customize their rollup chain to suit specific ecosystem needs. There are essentially two types of rollups:

Optimistic rollups and zk rollups

Optimistic rollups are ‘optimistic’ in the sense that transactions are assumed to be valid, but can be challenged if necessary. If an invalid transaction is suspected, a fault proof is run to see if this has taken place.

Zero-knowledge rollups use validity proofs where transactions are computed off-chain, and then compressed data is supplied to Ethereum Mainnet as a proof of their validity.

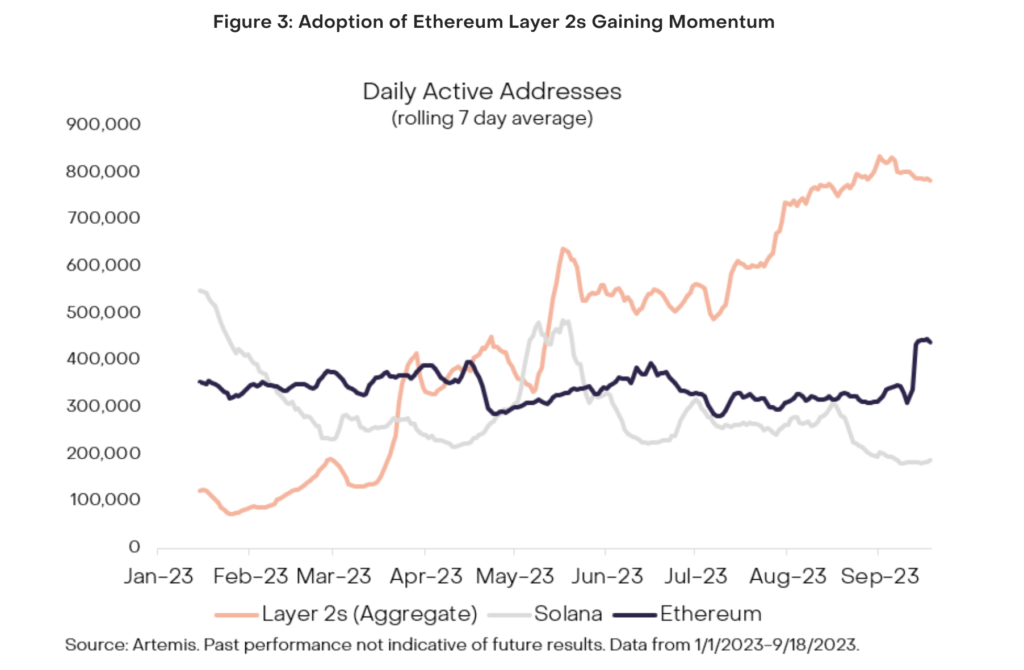

Knowing about how L2s leverage scalability, you can now naturally be able to make sense of layer 2’s aggregate of active addresses skyrocketing past Layer 1. At first look, we can easily conclude that since L2s gaining momentum its naturally benefitting L1… right? Let’s look into it.

Impact of L2s on L1s

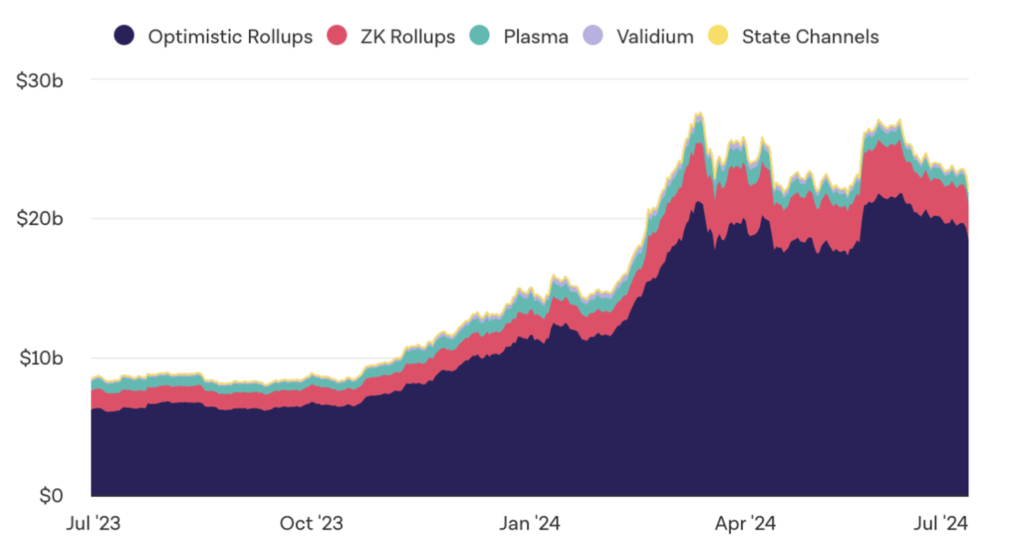

So now that you’ve understood the basic terms, we can finally move into assessing Layer 2 and its growth. Ethereum L2’s success is heavily due to the growth of Arbitrum and Optimism, along with the launch of Coinbase’s L2 called Base.

They add value to Ethereum’s network in the following ways:

- Increased Value Accrual to L1: L2s process transactions and send them back to the L1 for settlement. This generates fees for the L1, which can be used to improve the network and security. Additionally, L1s often burn a portion of their native token for each L2 transaction, further increasing the value of the L1 token.

- Enhanced Scalability and Usability: L2s help to alleviate the scalability issues faced by L1s, allowing for faster and cheaper transactions. This makes the L1 ecosystem more usable for both developers and end users.

- Strengthening the L1 Ecosystem: The success of L2s can validate the L1 model and attract more developers and users to the L1 ecosystem. This can lead to increased adoption and further growth of the L1.

Lets make this clear, L2s are not meant to replace L1s but rather to complement and enhance them. How good of a job are L2s doing then? How much are L1s profiting because of it? That’s our next objective and you would be surprised by the answer. Taking this in mind, we aim to look at the activity of Optimism and then look at the entire ecosystem to evaluate the impact of L2 on L1 protocols.

(Insights from Optimism)

Optimism, a layer 2 solution that utilizes ‘optimistic rollups’, distinguishes itself by utilizing ETH for transaction fees, reserving its native OP token exclusively for governance and security purposes. This unique approach is why our study will focus on Optimism as a proxy to determine the impact of L2 solutions on Layer 1 (L1) blockchains before branching out to analyse the entire space.

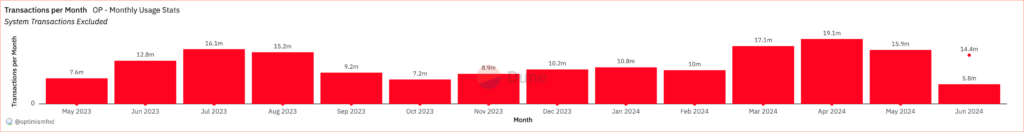

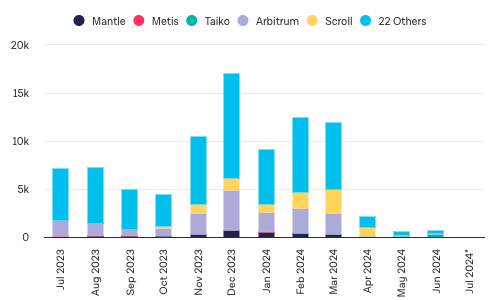

The protocol’s healthy activity of transactions per month gives us a hint that there should be a healthy amount of proportions flowing back to L1 from OP.

In recent months, we’ve observed some fascinating trends in blockchain transactions. While the overall number of transactions dipped earlier this year, they picked up significantly in March, reaching 17.1 million. Projections indicate a slight decrease to 14.4 million this month, which still suggests healthy activity.

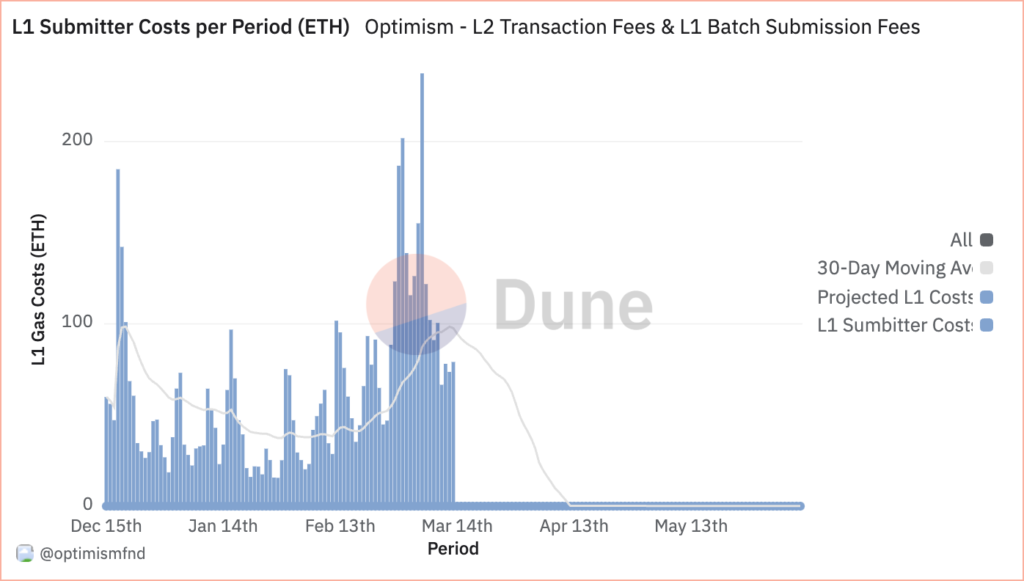

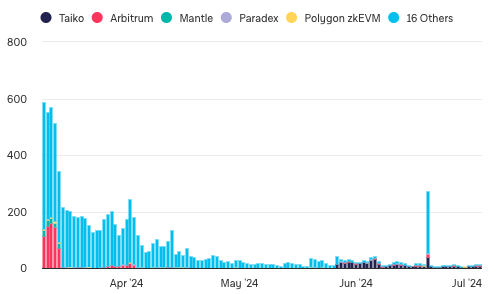

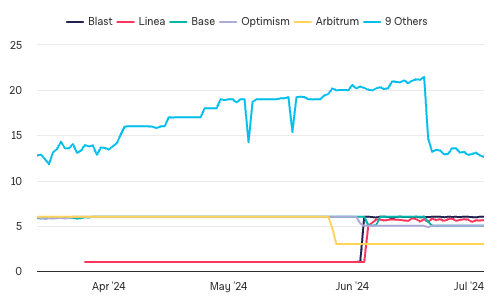

One particularly intriguing development is the sharp decline in Layer 1 (L1) gas usage since January. At first glance, this seems concerning and counterintuitive. Since L2’s are growing, shouldn’t the gas usage move up too? No, beucase Ethereum is always innovating its tech stack. In this case, they have introduced the concept known as “blobs”—a new feature that’s changing the dynamics of blockchain transactions, which will be discussed further.

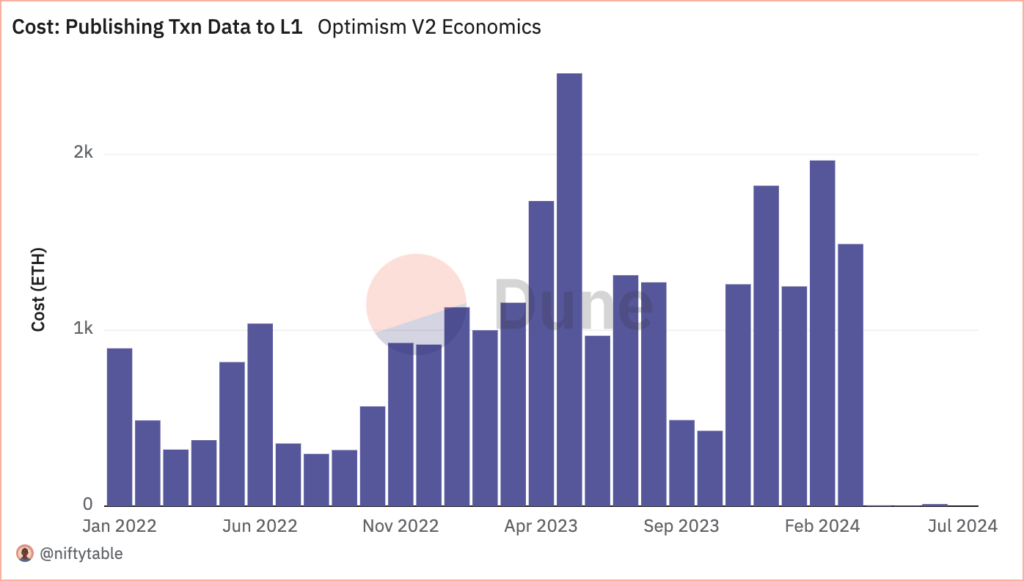

If we look at the data, we can see a notable decrease not just in gas usage per transaction but also in the costs associated with submitting data to L1. This trend suggests a reduced direct dependence on the L1, which might initially appear counterintuitive.

However, it’s important to note that L1 still forms the foundational base upon which these innovations are built. Profits and user engagement have actually skyrocketed with the advent of Layer 2 solutions. By alleviating some of the load from L1 and optimizing transaction efficiency, L2 solutions are providing numerous positive externalities to L1 and Ethereum.

Zooming out

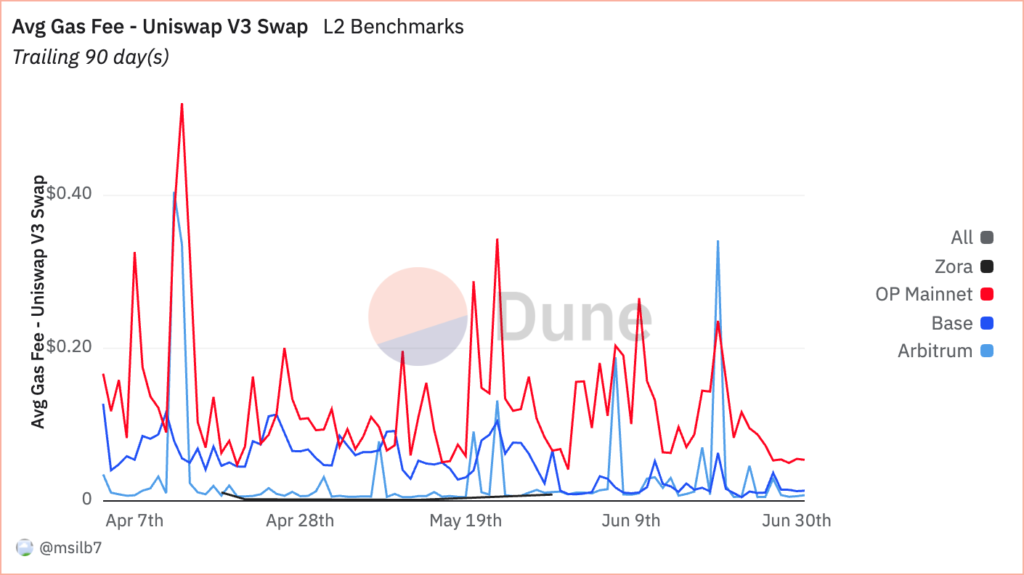

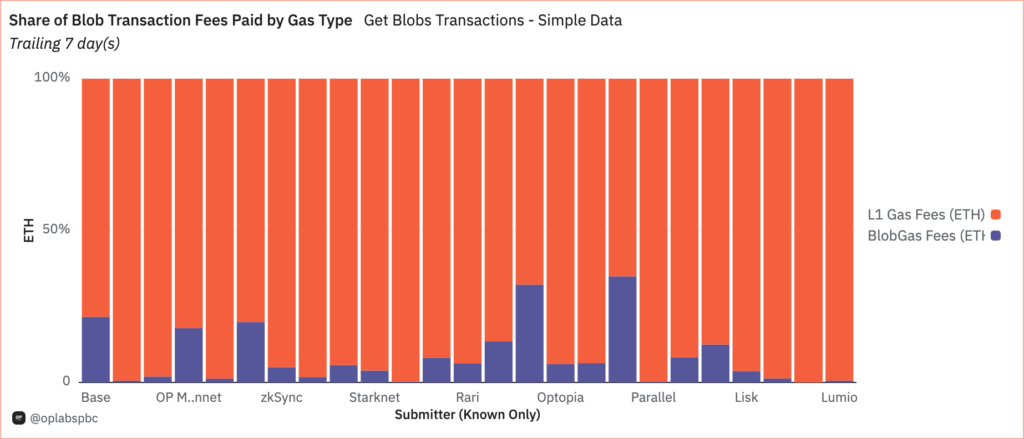

Across other Layer 2 (L2) protocols, we’re seeing a similar trend: a decline in fees directed to Layer 1 (L1). This observation leads to an intriguing hypothesis, for boosting ethereum’s scalabiilty to new heights, the market is shifting from the use of rollups to blobs. The reliance on rollups is staggering, resulting in a decreased impact on L1 revenue. However, this shift is exciting because these alternatives could significantly increase transaction volumes and introduce a wave of new protocols that would benefit the L1 as well. With the relative cost of storing data potentially falling by up to 98%, the blockchain ecosystem stands to benefit from enhanced efficiency and lower costs.

Adoption of Blobs and the impact on Layer 1

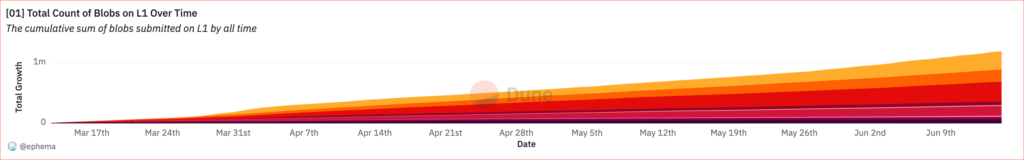

I’ve mentioned blobs too many times, it would feel wrong to not take a quick look on its activity across ethereum and of course that would confirm our hypothesis. Blobs are a new type of transaction where rollups can efficiently store transaction and proof data, saving gas when sending this information to the mainnet. This method offers an optimized way for L2s to interact with L1 blockspace.

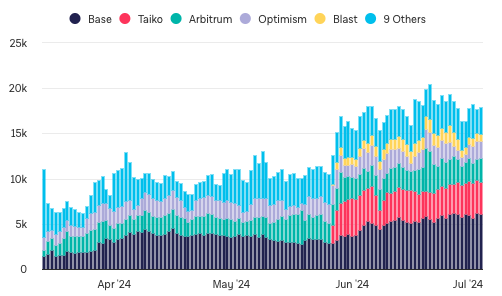

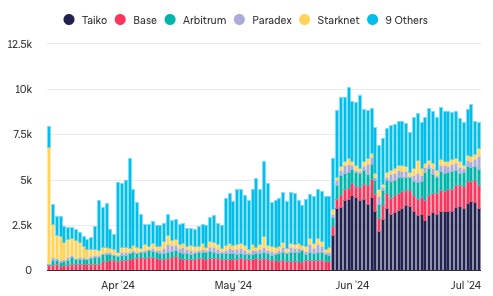

If you’ve observed carefully, you’ll notice how on the same timeline, where we notice staggering or falls in L1 data fees, the volume of usage for blobs show a steady rise over time, across chains and even per transactions. This hints to a strong indication that the market is indeed shifting and blobs may overtake rollups to solve the problem of scalability for ethereum in a more efficient and cheaper way. But, this also means lesser revenue being directed to L1s. On the other hand this new innovation is sure to bring about positive externalities to L1 by essentially reducing the costs for protocols, lowering the barrier just enough for an increase in the influx of protocols and transactions to ethereum.

There is also as always some resistance offered by the market. We see that average number of blobs per transaction by chain(on the left )is still yet to break out, suggesting the L2s are still in the initial stages of testing and slowly transition, naturally, towards a cheaper alternative to L1 fees. The adoption of blobs is still secondary, as shown in the graph.

L2 Security ≠ Ethereum Security

Ethereum L2s sure are have grown fast. Today, many of them have their own tokens and, in total, they process around 30M transactions per day. But , were they able to solve the trilemma completely? Well, these networks aren’t as decentralised as you may think.

These networks are still centralised and pose a relatively high risk to users. As such, many falsely assume that using an Ethereum L2 network is the same as using Ethereum. This is not true, at least for now. There’s still no widespread agreement over what being “secured by Ethereum” actually means. Similarly, debate over the definition of an L2 is ongoing.

To keep it general, when an L2 claims that it’s “secured by Ethereum,” it means that all transactions are settled to Ethereum without censorship or modification. However, these networks do not inherit all of Ethereum’s decentralisation and have weaker security guarantees in other areas, such as upgradability and relying on central operators to patrol the network .

The risk here is that if L2s can’t quickly decentralise, they may face regulatory pressures too, for example, force a chain rollback if an L2 user violates OFAC sanctions. Like when, Optimism almost crashed before it started, with the team patching an exploit that could’ve produced ‘infinite money’

Other risks also include

- Outage Risk: If the sequencer goes down, the L2 network can be disrupted, potentially leading to loss of funds or functionality.

- Extractive Actions: The centralized sequencer could potentially engage in activities like Maximal Extractable Value (MEV), where they prioritize transactions that benefit them at the expense of other users.

Conclusion

As Ethereum’s Layer 2 solutions and blob technology continue to shape the blockchain landscape, it’s clear that the path to true scalability is paved with innovation and adaptation. While challenges and uncertainties remain, the market’s embrace of new technologies signals a willingness to evolve, something you would expect from Web3 users and developers. The key to success lies in striking a balance between progress and prudence, harnessing the benefits of L2s and blobs while addressing their limitations. Ultimately, Ethereum’s future scalability will be determined by its ability to foster a diverse, resilient, and ever-improving ecosystem – one that seamlessly integrates new solutions and mitigates their risks.