Resilient Economies.

Title: What is the missing piece of all token economies these days? Building resilient designs

We need to build resilient economies because we are designing systems to be run by a decentralised community. The economy needs to be resilient because there is no “off switch” to press, like there is in a centralised governing community.

The more resilient an economy is, the safer that economy is.

People, Systems, Civilisation

Systems that we design are propagated by simplifying all the complexity down into some basic rules.

A question that needs to be answered is: “resilience to what and for whom?” Making something resilient is going to impact something else as there are always trade-offs in systems.

People are adaptable to situations such as disasters. What we are doing is to build adaptive systems that capture people’s adaptability. It is tougher to build resilient systems purely from the engineering perspective because they might not be able to account for the changing environment. We call these incomplete contracts economic.

However, we can add aspects of resilience or adaptability into the design of a system or economics. For example, pairing machines to aggregate data with humans, who can make better decisions based on the mountain of data. The biggest benefit is to create these adaptable systems to take advantage of the strength of both machines and people.

Machines can make some decisions or aggregate decisions to turn qualitative or quantitative stuff into a more digestible format. Humans are great at adapting the information produced. Machines and humans can work together to leverage the best of both strengths.

How can we build systems that align and mitigate the differences?

We need to build adaptability. Adaptability comes in two ways, imminent and intentional development.

How can we build adaptability?

Yes, adaptability is not something you can enforce. However, we can build different types of adaptability in the design.

Imminent Development

Imminent development is the development that happens naturally. For example, DeFi’s innovation.

This is something you cannot plan for or engineer. It is a development that happens naturally. In design, that means allowing space and flexibility for imminent development to happen. This is why some tokens fail because they did not factor in flexibility for imminent development in the model.

Intentional Design

Intentional development is where development is engineered. For example, gradual governance decentralisation.

The need to create open adaptable systems that continue to incorporate new knowledge to aid in the decision-making process has to be embedded in the design itself. This can also be an intentional milestone in the roadmap, as part of the design evolution of intentional development.

It is not possible to have one without the other. Both work together to adapt to new changes and adapt to new development. If we have one without the other, the system is not sustainable in the long run.

How can we incorporate both to create resilient economies?

In the end, economies are about decision making. Decision making is a social optimal function in which we are trying to solve something. How to best use the information (quantitative like machines, oracles, smart contracts) to apply to scenarios (qualitative like changes in user base, changes in market conditions), to make a decision that benefits everyone.

What you can measure, you can automate. Qualitative variables are hard to measure. Thus, this is where we bring in the human element to create adaptable systems.

Why is this important in DeFi and Crypto?

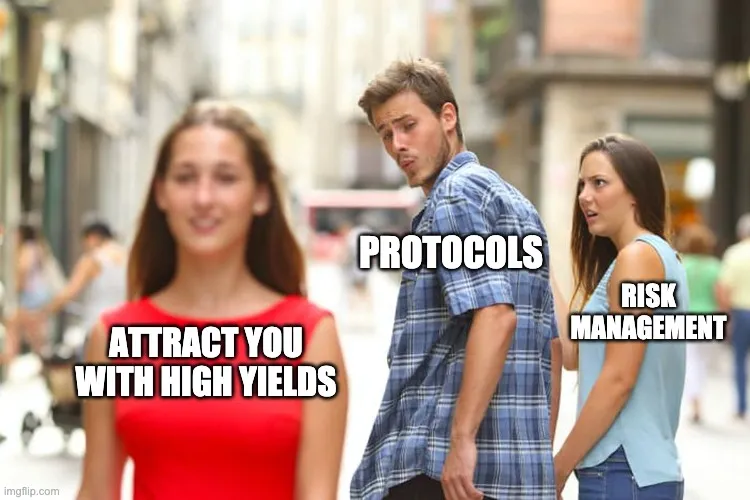

This is part of risk management. This is a conversation that I do not think we are having enough of. Yes, yield is attractive. But what is more important is to design and build resilient economies. The more resilient the system is, the more “protected” the primary market is.

That is why we cannot only consider yields. Look at risk. Understand how risk is managed. Understand what can be measured and what cannot. And then see what the protocol is doing to reduce its risk exposure. After all, it is your money too! Start having these conversations today. So that when events like March 18 2020 or April 18 2021 happen again, you do not find yourself suddenly liquidated or not able to pull money out of the protocol.

Resilience starts in the primary market. It starts at the level of core economics and systems design.

Ps: Order the textbook “Economics and Math of Token Engineering and DeFi” today!