Layer2

Welcome, premium subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers. Please keep these mails secret and do not share them with anyone because these alpha are confidential. Enjoy your reading.

TLDR below. This is not financial advice.

General Conclusion

Watch these videos for a comparison of Zk Rollup and Optimistic Rollup.

Polygon ($MATIC)

Overview of Polygon Network

What Is Polygon Network?

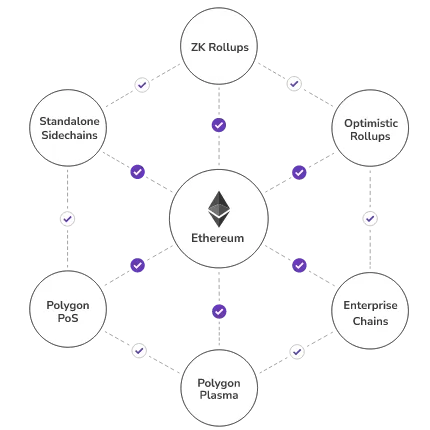

Polygon’s main idea is the “Internet of Blockchain”, but unlike other projects of the same idea (Polkadot, Avalanche, cosmos), Polygon focuses only on the Ethereum ecosystem, taking Ethereum as the main chain to connect everything.

More specifically, instead of providing a scalable solution like other projects, Polygon provides a Framework that makes it easy for Devs to build scalable solutions for Ethereum and allow them to connect within Polygon Network, the ultimate goal is to create an ecosystem of Ethereum-centric scaling solutions.

Source: https://polygon.technology/

Highlight

The structure of Polygon is divided into 4 layers:

-

Ethereum Layer (Optional Layer, not required): This layer is implemented as a set of Smart Contracts on Ethereum. By using them, Polygon Network can take advantage of the high security of Ethereum.

-

Security Layer (Layer optional, not required): This layer provides additional security functionality for the Polygon Network. This functionality allows Polygon Chains to periodically check the validity of any Polygon Chain using a set of Validators.

-

Polygon Networks Layer (Required Layer): Consists of sovereign Blockchain Networks where each network can maintain the following functions: transaction reconciliation, consensus, and block production.

-

Execution Layer (Required Layer): Responsible for interpreting and executing the transactions contained in the Polygon Chain. It includes Execution Environment and Execution Logic Sublayers.

Source: https://polygon.technology/lightpaper-polygon.pdf

In general, Polygon’s architecture is highly collaborative and customisable with 65k tps.

For example, networks that prioritise speed over security can simply use the top two layers, the Polygon Networks Layer and the Execution Layer. On the contrary, networks that want to increase security, in addition to the two layers above, can use more Ethereum Layer, Security Layer or both.

According to Polygon’s presentation, by combining 2 mandatory and other optional layers (Ethereum Layer, Security Layer), Polygon Network supports building two main types of Blockchain Network compatible with Ethereum: standalone network (Standalone Networks) and the network leverages security from Ethereum (Secured Chains).

Current Situation

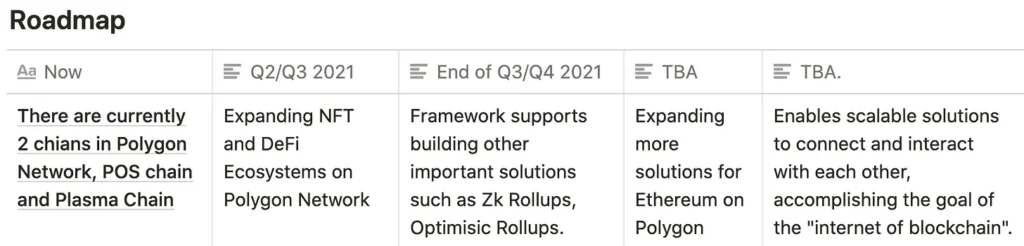

At the moment, Polygon is attracting projects in the NFT and DeFi segments to migrate from Ethereum or build directly on Polygon Network (3 – 10 projects weekly).

At the same time, Polygon is also completing the Framework to support building other extensible solutions (Stand-alone Networks, Secured Chains, Zk Rollups, Optimistic) which are expected to be released at the end of Q3 and Q4 respectively.

Once the foundation is complete, more Chains will begin to be built on the Polygon Network, eventually accomplishing the “Internet of Blockchain” goal” as mentioned.

Polygon Ecosystem

Overall at the moment, Polygon is growing quite strongly in the context of severe congestion of Ethereum and delays of other scaling solutions, Polygon emerges as a great alternative.

The important pieces of DeFi on the polygon gradually appear but they do not have many tight connections, this is mainly because the project is developing in the direction of “community-driven”.

Dex

The Dex model used mainly on the Polygon network is AMM, of which the most prominent are 4 projects:

-

Quickswap: This is a native AMM on Polygon, the project started as a Fork of Uniswap v2 on Polygon. Then began to develop more features, improve tokenomics so that products in the Quickswap ecosystem capture more value for the project’s native token, QUICK.

-

DFYN: this is a Multi-Chain AMM. The project started in Polygon and will expand to other Blockchains like BSC, HEC, AVALANCHE, POLKADOT, ALGORAND.

-

Sushiswap: Sushiswap is moving away from the shadow of an AMM and moving into a DeFi hub with many features and AMM is just one of them. Sushiswap currently supports 11 chains, including Polygon. Currently, the project is one of the AMM with the highest TVL.

-

Curve: A dedicated AMM for Stablecoin Assets is also going the Multi-chain route. After supporting Polygon and using appropriate incentives, the project quickly raised a large amount of TVL from users.0

Lending & Borrowing

Aave launched on Polygon extremely well, in just a month Aave has raised over $4B, which Aave took quite a while to achieve on Ethereum.

A sound liquidity Farming strategy and Aave’s reputation are the main things to help the project achieve this.

Yield Platform

With the strong development of Dex and Lending & Borrowing, they have created a huge yield source for products related to yield mining (Yield aggregator, Yield Farming & Yield optimizer Platform).

In addition, due to the extremely low fee (.000x$), the operating cost of smart contracts will be significantly reduced => there are more new Farming strategies born such as:

-

Auto Compounding: This allows the protocol to automatically sell part of the reward and add liquidity to automatically increase LP, thereby helping users farm more profit.

-

Auto Stake (support Quickswap): allows automatically Harvested $QUICK and staking $QUICK to receive Quick profit Shared ($dQICK).

Stablecoins

Most of the 3 popular stablecoins used on Polygon are DAI, USDT and USDC. They are exposed to Polygon by Wrapped, the number of these Stablecoins circulating on Polygon has increased continuously recently (over 700M$ in total).

Native Stablecoins on Polygon is currently still making a potential piece of the Polygon ecosystem, for example, accepting $MATIC as collateral and minted out native Stablecoins on Polygon network.

Oracle & NFT

Does not appear much on press releases, but currently on Polygon also supports many different Oracle platforms: Chainlink, Gravity Protocol, Cartesi, etc.

Besides, the number of NFT projects in general moving from Ethereum to Polygon is very large, but the scope of NFT is very wide, in which the two niches that I see the most development are gaming and marketplace.

-

NFT marketplace: Opensea, Mintable, Tokentrove, Doki Doki, Ethercards, Arkane Network.

-

NFT gaming: Decentraland, Neon Fistrict, Terra Virtual, Aavegotchi.

Most of these projects are in the early stages of development, with not many outstanding updates yet.

Summary

-

Polygon is a layer 2 scaling solution for ethereum, taking the idea of “Internet of Blockchain” with Ethereum as the chain that connects everything similar to the Polkadot architecture.

-

Polygon’s pos chain is fast, cheap, and quite easy to use for those familiar with Ethereum.

-

DeFi Ecosystem on Polygon is growing exponentially, especially DeFi and NFT key sectors.

-

The yield-related sector could be one of the next thriving sectors on Polygon.

Optimism

What Is Optimism?

Optimism is a layer 2 project for Ethereum consisting of 3 main components:

-

Ethereum mainnet: Optimism’s security platform.

-

Optimistic Rollup: The core of Optimism’s scalability. This is a layer 2 solution to help make transactions fast and cheap but still, keep the security from L1.

-

Optimistic Virtual Machine (OVM): A virtual machine compatible with Ethereum, making projects work like they are on L1 Ethereum.

The Ethereum Virtual Machine (EVM) is the environment for running Ethereum’s smart contracts. Simply put, OVM is a scalable EVM that handles a large number of smart contracts.

Source: https://optimism.io/

Benefits of Optimism

Transaction

The processing speed is fast, the gas fee is reduced from 10-100 times the current.

According to the project TPS (transactions/second) currently supported are:

-

ETH 1.0 (currently): ~200 tps.

-

ETH 1.0 (optimised): ~2,000 tps.

-

ETH 2.0 (sharded): 2,000 x number of shards.

Convenience for Convert and Security

-

Fully supporting EVM, Ethereum dapps can be run on layer 2 with just a few lines of code.

-

Still retains the security from layer 1.

Initial Test and Results

Below I will give information related to the test run of the current leading project, Synthetix ($SNX) on Optimism’s OVM for evaluation.

1188 traders, 12,000 trades and a total of over $600 million in trading volume were executed in the first 2 weeks of the Synthetix layer 2 trading competition.

A few famous names that have participated have shown interest in the project when moving to layer 2.

The result is a 143x decrease in Gas usage, 3.3k Gas on Optimism compared to 472.2k Gas on Ethereum. The average confirmation time is 0.3s, 5 times faster than Ethereum’s 15s.

Summary

-

Although there is much interest from famous projects, the number of Dapps on optimism is still modest. Currently, only Synthetix, Uniswap, and Opswap (new Dex) are in the test.

-

Currently, Optimism has not officially mainnet yet.

Arbitrum

What Is Arbitrum?

Arbitrum is a layer 2 scaling solution for Ethereum. According to the shared project, the project plans to provide 3 scaling modes: Rollup (OPU), Channels, Sidechains. Currently, the attention of the Ethereum community is on the eye of Arbitrum’s Rollup (OPU). For the other two solutions, we don’t have much information.

What Is Rollup on Arbitrum?

Rollups are a type of Layer 2 scaling solution that allows rolling sidechain transactions into a single aggregate block and posting to the Ethereum blockchain. This allows transaction data on layer 2 to be available on layer 1 whenever needed to validate a state transition.

Highlight

Arbitrum provides an extensible solution of the Rollup model. The main difference of Arbitrum has to do with how Fraud Proofs work.

For example, if someone proposes a Rollup block and another believes it is incorrect, how will the project resolve that disagreement?

Arbitrum uses a multi-round rollup protocol for dispute resolution, where Arbitrum subdivides the dispute until it is a very small one and then resolves it on-chain.

Pros and Cons of Arbitrum

Pros

The “multi-round rollup” approach allows Arbitrum to significantly reduce the costs associated with Fraud Proofs. The project is towards a lower cost solution with wider applicability (Support for highly complex txns).

Fully compatible with EVM, the experience is similar to that of working with smart contracts on L1 and compatible with ETH tools. In addition, Arbitrum can execute EVM code directly, even without the need to recompile smart contracts.

Withdrawal time on Arbitrum is also lower than other Rollup solutions (Arbitrum is about 1 day, on Optimism is about 1-2 weeks). The project is approaching a number of other solutions to lower the withdrawal time (Connext).

Arbitrum Mainnet at the end of May, projects and developers can develop their projects on Arbitrum (optimism is open in stages, slightly private, in the first phase only a few top projects are Deployed on Optimism).

Cons

The “multi-round rollup” approach also makes the dispute resolution process take longer.

Arbitrum is ambitious when it comes to supporting many other scaling solutions (side chains and Channels), the complex transition between these solutions is a problem and has not seen much of it.

Arbitrum Ecosystem

Prominent platform projects have integrated with Arbitrum, some of the tools are familiar to developers on Ethereum, most of which are on Arbitrum, for example, The Graph, Truffle, Hardhat, ethers.js, web3 .js, Brownie.

Arbitrum team also builds some core DeFi products themselves, such as:

-

Arbiswap: Uniswap on Arbitrum Rollup. Same functionality as UniSwap.

-

L1, L2 bridge: Transfer Arbitrum Rollup assets to Ethereum and vice versa.

-

AARBE: Decentralised lending Pool with flashloan support.

-

FakerDAO: MakerDao on Arbitrum.

Summary

-

Arbitrum is a layer 2 scaling solution for Ethereum. As they shared, they plan to offer 3 scaling modes: Rollup (OPU), Channels, Sidechains.

-

Arbitrum’s core differentiator is its “multi-round rollup” approach, which is a trade-off between speed & transaction fees and the complexity of dispute resolution. This is understandable because the project is aiming for a low-cost solution with wide applicability (Support for highly complex txns).

-

Although the ecosystem on Arbitrum is “small” but “sufficient” when the main DeFi puzzle pieces have been fully built.

-

Overall, Arbitrum is “good enough” and “available to deploy” so it could be an upcoming big player in Layer 2 ecosystems.

TLDR:

Currently, Polygon is taking advantage of the demand from the market when Ethereum is congested. The cost is much cheaper when users transact on Polygon and brings many advantages in product diversity as well as attracting users. This is also the advantage of the entire Layer 2.

Besides, Optimism and Arbitrum are 2 different Layer 2 solutions from Polygon (in terms of technology). Both use Optimistic Rollup technology, while Polygon offers 2 technologies, POS and Plasma. So Polygon has a cost advantage over Optimism and Arbitrium. This is probably the feature people are most interested in.

Finally, when the market explodes, the demand for layers will soar. Technologically may be different, but clearly users only care about transaction costs and security along with convenience. Therefore, projects need to be clever to exploit these needs as competition increases.