Portfolio Management Protocol.

Welcome, premium subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers.

Please keep these mails secret and do not share them with any one because these alpha are confidential. Enjoy your reading.TLDR below. This is not financial advice.

General Conclusion

In the traditional financial market, you may be quite familiar with the “index baskets” such as S&P500, Dow Jones Industrial Average (DJIA), etc. These index baskets each include a lot of financial assets. Products designed by leading experts, helping you diversify your portfolio risk and achieve investment performance in the simplest way.

In this article we will compare 5 blockchain-based asset managers by their goals, how they work, and what is the use case of their tokens.

Yearn Finance

yEarn Finance is a liquidity aggregator, running on the Ethereum blockchain for lending platforms. yEarn Finance helps users achieve the highest profit during smart contract interactions.

What is the problem that yEarn Finance sets out to solve?

Liquidity mining programmes like Compound or Aave are places that allow LPs (liquidity providers) to provide liquidity and earn profits.

Currently, more and more similar protocols are appearing, with flexible forms of change. The problem is: how can LPs maximise their profits? It is very difficult to switch between protocols continuously.

yEarn Finance was born to solve this problem. It makes it easy for users to optimise profits with algorithms to compare, choose the place with the highest revenue, save research time and switch between parties.

yEarn uses the following protocols for aggregation: Compound, dY/dX, Aave, Curve, and supports the following stablecoins $DAI, $USDC, $USDT, $TUSD, $sUSD, and more.

How Yearn Works

Yearn Finance generates much of its activity thanks to an activity commonly known as “profit farming,” in which users lock their cryptocurrencies in a decentralised finance (DeFi) protocol to generate interest – usually in the form of more cryptocurrency. The more cryptocurrencies a user locks into one of the supported platforms at a time, the more tokens they will be awarded.

These tokens can come from another project, $YFI, or both. From there, the amount of tokens received is the profit that the user earns.

The protocol works as follows:

[1] Investors deposit their funds into available pool strategies. [2] The amount obtained will be yielded through the pools that interact with the 3rd project. The amount will be accumulated periodically to maximise profits. [3] Investors can withdraw the initial capital + profit (after deducting management costs) at any time.

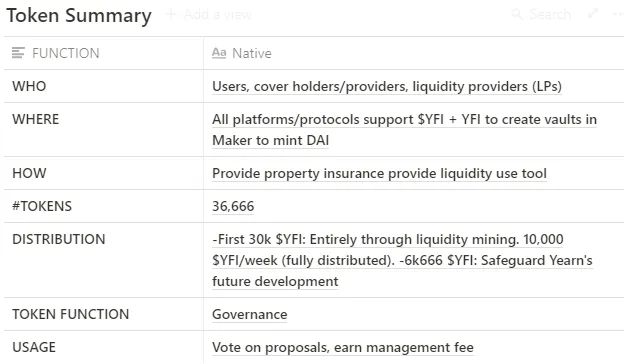

$YFI Use Case

$YFI token is a governance token in the Yearn.finance ecosystem. It is 100% released through liquidity mining and allows holders to govern the system and earn a reward through staking. The total supply as of Q2 2021 is 36,666 $YFI tokens in the market.

Dhedge

dHedge is a decentralised asset management protocol built on Ethereum. dHedge allows anyone to create their own investment fund on Ethereum or invest in funds managed by others in a completely non-custodial way using Synthetics Assets. dHedge brings decentralised, permissionless services to traditional wealth management services.

How Dhedge Works

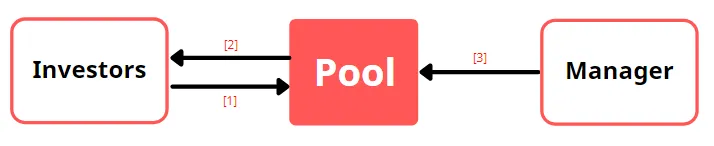

The basic operating model of dHedge has three main components interacting with each other according to the following mechanism:

[1] Investors deposit $sUSD into pools managed by managers.

[2] As proof of their deposit into the pool, the pool will return pool tokens to them, with the number of tokens calculated based on the amount they deposited divided by the price of the current token pool. Pool tokens increase in price as managers’ trading strategies make the pool profitable.

[3] Managers are fund managers who trade using the amount of assets available in the pool. The amount of management fees that fund managers charge on investors’ profits is the motivation for managers to do their job well. Managers can customise the management fees in the funds they manage.

In addition, fund managers can be human or bot, because there are many existing trading strategies that can be run by bots, with efficiency and accuracy many times higher than humans.

Managers interact with the pool interface, through which they interact with synthetic assets — Synthetic Assets from Synthetix and through ChainLink’s Oracle.

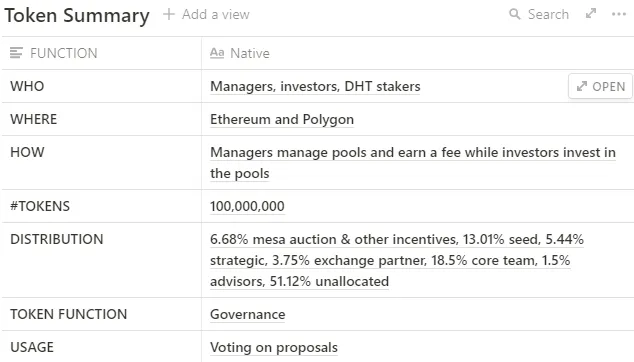

$DHT Use Case

$DHT is the governance token of dHedge, used for the following purposes:

-

Governance: $DHT holders have the power to shape the future of the dHedge protocol by voting.

-

Incentive reward: Incentivise investors to invest in asset pools with top performing managers and also incentivise managers to earn more revenue, both of which earn $DHT.

-

Staking reward: Stake $DHT on Uniswap pool to provide liquidity, in return $DHT holder will receive an additional amount of $DHT as a reward.

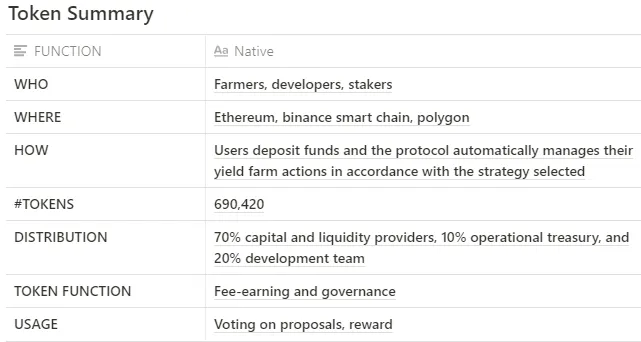

Harvest Finance

Harvest Finance is an automated yield farming protocol that allows profit sharing between ‘hard worker’ and ‘farmer’.

Harvest Finance automatically collects the highest returns from DeFi protocols and optimises the profits received using the latest farming techniques.

How Harvest Works

Harvest Finance offers solutions to solve problems such as the need for a long time to track yield farming opportunities, expensive gas fees or hard-to-test smart contracts, bugs that lead to property theft, etc. how to implement strategies to move assets between different yield farming opportunities to maximise profits.

At the same time, Harvest also takes care of monitoring APY, information on strategy development, audit and gas fees.

As a result, Harvest Finance helps farmers save a significant amount of gas fees, and also increases the profit APY farmers can achieve.

Harvest’s operating model:

[1] An investor deposits money into a pool that supports his/her assets. [2] Harvest will look for the largest return associated with that property. [3] Investors can withdraw assets at any time and will have to pay management fees.

$FARM Use Case

$FARM is the governance token of Harvest Finance, used for two basic purposes:

-

Governance: Farm holders can vote on proposals for the Operational Treasury.

-

Staking reward: Farm holders receive 30% of profits generated by the liquidity pool when they stake $FARM in the profit share pool.

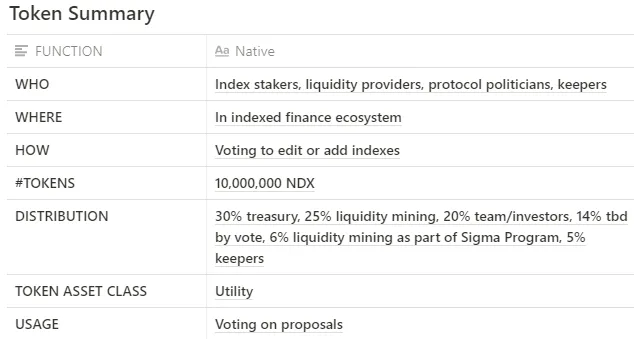

Indexed Finance

Indexed Finance is a project focused on developing passive portfolio management strategies for the Ethereum network.

Indexed Finance is managed by $NDX governance token holders, which are used to vote on protocol update proposals and high-level index management, such as defining market sectors and creating new management strategies for investors.

How Indexed Works

Indexed Finance combines multiple tokens in a division and combines them into a single Index Token. This helps to diversify the portfolio, increase stability and reduce the risk of one token in the portfolio being hacked.

Each Index Token will be controlled, created and distributed by users holding NDX data. Currently, Indexed Finance has four Index Tokens, including:

-

CC10 Index: A collection of $LINK, $UNI, $AAVE, $SNX, $CRV, $UMA, $YFI, $MKR, $OMG, and $ZRX.

-

DEFI5 Index: A collection of $UNI, $AAVE, $COMP, $SNX and$ CRV.

-

ORCL Index: A collection of $LINK, $ORAI, $DIA, $BAND and $UMA.

-

DEGEN Index: A collection of $RUNE, $REN, $RSR, $CRV, $1INCH, $ALPHA, $OCEAN, $BADGER, $DOT and $MIR.

Users simply need to swap into the index that they want to own.

$NDX Use Case

$NDX holders have the following administrative rights:

-

Implement new index token pools.

-

Manage and allocate tokens in index tokens.

-

Approve new management strategies.

-

Set system configurations such as swap fees.

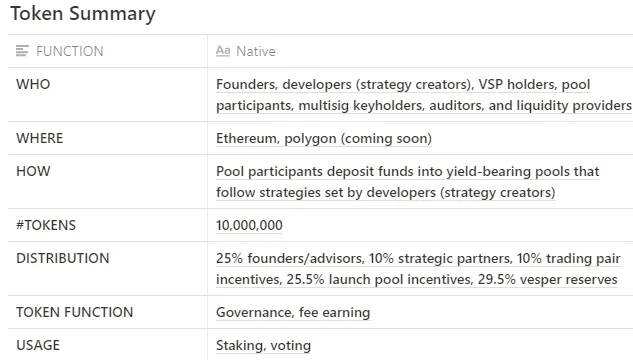

Vesper Finance

Vesper provides a platform for DeFi products that are easily accessible to users. Vesper DeFi products make it easy for users to achieve financial goals in the crypto space.

Vesper Products: At launch, Vesper offered many profitable “Grow Pools” that allow users to increase profits from holding coins like BTC, ETH, VSP, DAI, USDC. Vesper Grow Pools represent the first product on the Vesper platform. Further products will be provided to users in the near future.

Basically, it’s like Yearn.finance (YFI). Vesper helps users maximise profits by automatically sending their funds to high-interest protocols: Compound, AAVE, Curve, Uniswap, etc.

How Vesper Works

Is minimising investment complexity the fundamental reason for Vesper’s success in attracting capital and users? The answer is hidden in the mechanism of action. Let us find it.

Vesper’s core product is “Grow Pools”, with “conservative” and “radical” strategy pools. The product previously supported higher mortgage rates, and liquidity only flowed into MakerDAO, Aave, Compound, and more. The second pool (the “radical” pool) allows users to increase revenue with a lower mortgage rate and so maximise capital efficiency, most of which interacts with new agreements or unaudited agreements (such as Harvest).

If the market is highly volatile, the “radical” pool is more likely to trigger liquidation, but the return is also higher.

When users use Vesper, they can choose a strategic pool based on the rate of return and of course, they can also invest their assets in multiple pools. Vesper will then implement liquidity pooling for DeFi protocols like Aave and Compound to generate revenue.

$VSP Use Case

The total number of $VSP is 10 million. $VSP can be used as a governance protocol and staked. Stakers also use their tokenised $vVSP shares to vote in Vesper’s governance, which can take the form of the following:

-

Approval of strategies proposed by the developer community

-

Deployment of Vesper reserves to incentivise new products

-

Alterations to the Vesper governance and revenue specifications

Participation is extended to $vVSP only, so that long term holders staking to earn more $VSP are also the ones that make decisions for the ecosystem through voting.

TLDR:

Asset management is a large market sector in traditional finance with revenue generating $4.2B per year. This is an opportunity for non-crypto native users to tap into the growing DeFi opportunity, and for the DeFi projects to move in this direction or collaborate with existing partners.

In this article, we have shown how five asset managers work. These managers are basically quite similar in operation and token use case. However, each strategy in each protocol is different, leading to different rates of return.