FEI Protocol.

Welcome, premium subscribers! Thank you for subscribing. I appreciate you very much.

TLDR below. This is not financial advice.

Catch the episode on YouTube

Introduction

Parallel to the development of Defi platforms is the development of stablecoin platforms. Fei Protocol believes that there are many stablecoins in the market right now. But each type will have different disadvantages.

For example, USDT, USDC are controlled by centralized authority, stablecoins backed by tokens like DAI have scalability problems. Stablecoins like ESD are centralized in the rewards provided by the platform. These factors create an unequal distribution of stablecoin growth.

Because of this, Fei Protocol has launched FEI, a stablecoin with USD equivalent value, decentralized, liquid and scalable, making Defi platforms freely accessible to everyone. due and safest.

FEI Summary

There are two tokens in the FEI Protocol:

-

$FEI is an algo stablecoin. It changes the supply and does a lot of other things to maintain that one dollar mark.

-

$TRIBE is the governance token which can be used for voting on different kind of things.

How is it special?

The protocol sold $ETH for $FEI. FEI is not like Maker where you are depositing $ETH to borrow out $DAI. You are selling $ETH to get $FEI out, instead of borrowing $FEI against $ETH as collateral. To get $FEI back, it is not repaying a collateral fee, but to sell $FEI on Uniswap for $ETH. This is a trade, so your $ETH is no longer yours once you sell it.

The liquidity pool on Uniswap is what is special. It is partially owned by the protocol. They call it the PCV or the Protocol Controlled value.

There are direct incentives and punishments to the users through taxation and subsidising. It is so big because they raised 1.3 billion dollars in ETH. The first billion was raised in 24 hours.

Token Design (FI): Direct Incentives

What are Direct Incentives?

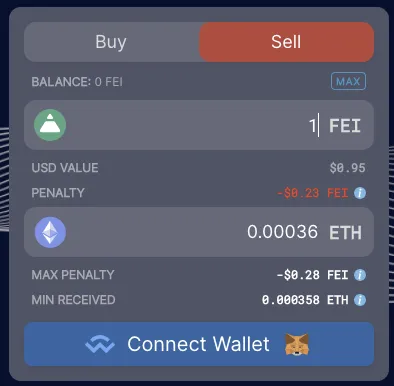

FEI do not have this particular penalty anymore but here is a screenshot showing a penalty.

You have direct incentives where you can buy and sell $FEI at whatever value. The USD value is, let’s say 95 cents, but there is a penalty added if you remove some tokens because you are punished by an additional tax.

According to the image above, when you take 1 $FEI out, which is valued at 95 cents, you will lose an additional 0.23 as a penalty and you are effectively only getting back about 77 cents. The idea is good because it does not make any rational sense for you to remove your FEI when prices are low since you have to pay additional taxes.

But people do not always act rationally, which is what happened with FEI. When prices fell people started to get worried and uncertain about everything. They started doubting the ecosystem and wanted to get their money out and as a result, more and more people were trying to sell their FEI. This suppressed the prices. The penalty got larger and larger and things went a bit south.

How was the penalty calculated?

Taking the screenshot as an example, the difference between one dollar and the USD value of 95 cents is $0.05. The penalty is a square of the difference so the square of $0.05 is $0.25. The penalty is about 23 to 28 cents so around 25 cents. If you go with that concept the biggest difference or penalty that you can get is one dollar or 100 cents because the square of 10 cents difference is 100 cents which means if $FEI drops below 90 cents then you have to pay to liquidate FEI.

Incentive Side:

The incentive side is that when $FEI is less than one dollar, and you mint more $FEI by putting $ETH in, you get bonus FEI.

Economics Fundamentals

-

Supply

-

Demand

-

Willingness to buy/sell

-

Incentives

-

Punishments

-

Behaviours

We all understand supply and demand but we often do not consider the importance of the willingness to buy and sell which is very important, because this is what dictates people’s behaviour. Punishments and Incentives are how you affect people’s behaviour, which is something that we want to manage and learn how to analyze a bit more.

Three Areas where FEI went wrong

1. Mechanism Design

Mechanism Design is the rules of the game or the rules that the participants and tokens have to abide by. They constrain what you can and cannot do.

Fundamentals: Incentives, Punishments and then Supply and Demand.

Free money by arbitrage

FEI is a new protocol and a stable coin, so so to bootstrap this protocol you have growth hack. One of the growth hacking methods FEI used was a bonding curve launch where people put $ETH in to get $FEI out. To incentivise people they offered a bigger discount if they came in early. For example, if you came in early you could buy FEI at 50 cents and you know that FEI is trading at $1 so then you can arbitrage and get the free 50 cents.

This mechanism is great to bootstrap your economy but also you are probably attracting the wrong kind of people because they are looking at quick gains and as long as prices reach one dollar they are willing to liquidate, even if they have to pay some amount of penalty because they have already made money through the arbitrage.

Free $TRIBE

Anyone who puts $ETH in to get $FEI out is also rewarded with $TRIBE tokens. This is where the protocol kind of prints free money and gives out this monopoly money. These $TRIBE tokens are governance tokens. These tokens do not really need any value and are risk-free so there isn’t much incentive to hold it and so most people just sell it.

Direct incentives

You have the bonding curve incentive, the $TRIBE incentive and the other systems of taxation or subsidy. When $FEI goes above or below one dollar these are the direct incentives.

One of the problems is the circular economy. In a circular economy, things are very closely related to each other. It’s like a constrained loop or a little world on its own. Money does not really go out and just continues to stay in the system. For this reason, what you want to consider are the secondary and tertiary effects of how this free money via arbitrage and free TRIBE tokens will affect the economy in the long run.

2. Secondary and Tertiary effects

Fundamentals: Supply/Demand and the willingness to buy and sell.

$TRIBE supply (risk-free):

The system is just giving out $TRIBE tokens for free and because of that the $TRIBE tokens that you sell are going to be risk-free. If you’re one of the early users then you’re already earning free money through arbitrage. On top of that you’re also getting free $TRIBE tokens and these $TRIBE tokens don’t really need any value and are risk-free so there isn’t much incentive to hold on to them and so you just sell them. This caused a big sell pressure in the market as a result of which the prices were suppressed quite a bit.

The other thing is that the only way to get out of $TRIBE, or to make a profit from $TRIBE, is to turn $TRIBE tokens into $FEI and then turn $FEI tokens into $ETH so you have to jump through a lot of hoops to get your free money out.

Willingness to sell $FEI (liquidation)

Firstly you’re more willing to sell $FEI because you’re going to make profits via arbitrage and secondly you want to cash in your $TRIBE profits. You have to sell at a discount because of the penalty, but that does not matter really since you are going to get profit in those two ways. You see a lot of sell pressure here and because of that other people get worried and try to sell as well, so you have a kind of secondary and tertiary effect.

Willingness to buy $FEI

$FEI is less than one dollar now. The incentive mechanism is to get people to put more $ETH in and to mint $FEI out to get bonus $FEI but people still are not doing that.

The secondary effect is that I put my $ETH which is quite liquid and turn it into $FEI which is a stablecoin, but no one accepts FEI and I can’t really use it. I can sell $FEI back for the price that I bought it at but that is just not rational and so people are not willing to buy $FEI to start with. People are constantly trying to liquidate $FEI because they want to cash in their $TRIBE returns and because of that, there are more secondary and tertiary effects.

3. Communities and VCs

Fundamentals: Behaviours

Information Asymmetry

Some people have more information than others and because of that they are able to profit off some stuff or can get into systems earlier and benefit a lot more than others.

FUD: Fear, Uncertainty and Doubt

Let’s say people with information asymmetry who have more information get free $TRIBE and free alpha and they’re trying to cash in their profits by selling $FEI. This puts a little bit of sell pressure but it’s okay because they can afford those fees. The other people or the retail guys who do not have this information see that people are selling and get very worried. The fact that the price is low and there is punishment but still people are liquidating worsens the fear and so they try to sell as many tokens as possible even at a discount.

Economics Lessons

1. Game Theory

In game theory, the general idea is that punishment fees can help to restore the prices when they are suppressed below one dollar. The problem here is that because of the tertiary effects of behaviour the punishment fees make things worse because prices are already low and you are punishing people for liquidating and increasing the punishment as prices fall lower.

Firstly people are less likely to return. Secondly, if you do not think that there is a future to the token and you do not think that there is an expected value, then you just want to liquidate right now because you want to cut your losses. The direct incentive affects people’s expected future of what the system will be — they see everyone is leaving and that creates a lot of uncertainty.

As an individual can have your own doubts, but in this case your doubts are confirmed because you can see people are paying to exit. This is like a community oracle where everyone is signaling to you that this protocol is not going to make it, so you leave now and cut your losses.

2. Secondary Effects

In algo stablecoins, if the coin is worth more than a dollar then it is easy, you just increase the supply. But if it is worth less than a dollar, then what can you do? This is literally a billion-dollar question or more specifically a 1.3 billion dollar question and anyone who can solve that will get a lot of benefits.

This secondary effect is not just about figuring out how to manage when the token is below one dollar but it is about considering the secondary and tertiary effects. You have to model all these economic effects to understand which system is the most robust, which system works the best and which system corresponds to people’s behaviour the best. This is not just about engineering — it is also about the economics and the economic modeling of these beautifully engineered systems.

3. Dynamic Engineering

This is an example of a situation where you have to constantly engineer the system. You have to account for changes in the ecosystem, you have to account for the participants in the system and you have to account for the collaterals received. I do not think that the FEI protocol expected so many people to put money in. This system could probably work if you do not have that many people coming in, and if you do not have a lot of people looking for a quick buck. This system could potentially work with a lot of believers at the start.

Listen on podcast if you prefer audio version.

TLDR:

Fei has different mechanisms in place for above and below the peg. Most new supply comes in on a bonding curve denominated in ETH that fixes slightly above the peg. This is a price ceiling for FEI, any secondary market price above this can be arbed down.

Below the peg, the normal mechanism is “dynamic incentives”. This means when traders sell there is a burn on their FEI balance (only the trader selling). When they buy there is a mint which is lower than the burn that led to that point. Dynamic incentive uses dynamic mint rewards and burns penalties on DEX trade volume to maintain the peg. At least one incentivized DEX acts as a hub. Rest of the exchanges/secondary markets can arbitrage with the hub. This helps maintain the peg throughout the ecosystem.

The Fei protocol, also has governance token, TRIBE. TRIBE comes both from a liquid DEX offering and from liquidity incentives for supplying FEI/TRIBE liquidity.

Ps: Order the textbook “Economics and Math of Token Engineering and DeFi” today!