Analytical Report

Welcome, subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers.

Please keep these mails secret and do not share them with any one because these alpha are confidential. Enjoy your reading.

One significant source of financial risk of stablecoins comes from collaterals and reserves that maintain the pegged value of these tokens. The management of these collaterals and reserves directly impacts the ability of the token staying at a constant price, thereby affecting token holding behaviours and financial risk for investors. For stablecoins, collateralised with other tokens, such financial risk exposures are relatively simpler to analyse as all information is available on chain. But for stablecoins backed with off-chain assets, the lack of real-time updating information on reserve and missing standardised reserve disclosure requirements both add to the challenge of risk analysis. In this article, we will walk through the financial risk of stablecoin protocols coming from such fiat reserves from two perspectives: quality of reserve and information transparency.

Introduction to off-chain reserve

As the name suggests, off-chain reserve refers to the collateral pool made up of traditional asset classes that are not transacted on the blockchain. This includes cash, treasury bills, commercial papers, fiduciary deposits, secured loans, bills, corporate bonds and other investments like precious metals. In order to keep the token at a fixed value, the value of reserve needs to be proportional to the number of tokens in circulation, often at a 1:1 ratio. The reserve is usually held by financial institutions or a central issuer, depending on how the token is designed and its compliance to regulations. In the market today, some of the top performing stablecoins with off-chain based reserve include USDC, BUSD and USDT.

In general, off-chain stablecoins have better resilience against financial risk exposures when they have higher quality reserves and demonstrate high disclosure transparency on the relevant reserve information.

Quality of reserve

The term quality of reserve means a combination of liquidity and credibility of assets in the whole reserve. To better control the proportion between token supply and reserve value, protocols need to ensure their reserve is made up of credible assets with high liquidity. Some key indicators to consider are the percentage of each asset type (especially for cash and cash equivalents), credibility of bond issuer, maturity dates of bills, and regulations that oversight the fiat assets.

While quality rating methodologies may vary across the different asset classes, and we do not have a specific quantitative system that combines all asset types to evaluate overall financial risk exposures from reserves, the general rule is that financial risk exposure is lower when reserve value is less volatile and prone to less instability. The reserve should maintain a high proportion of cash and cash equivalents with short maturity and high liquidity. Bonds and bills included should be issued from a trustable source with high credit ratings. The reserve should also be held by regulated financial institutions to ensure proper management such that the token supply to reserve value ratio is maintained at a fixed level.

An important point to note here is that many protocols combine reserve figures for cash and cash equivalents as one big category in their financial reports. We need to be aware of their definition of cash equivalents, and see if it corresponds to the commonly accepted definition of assets that can be readily converted into cash.

Information transparency

In addition to reserve quality, it is also important to analyse the level of disclosure transparency provided by the protocol when it comes to reserve information. Since the assets are off-chain, the amount of reserve information available is entirely dependent on how much the protocol chooses to disclose. Protocols that release only partial or irregular information are considered to be less transparent with reserve information, and this would increase the level of uncertainty in the long term.

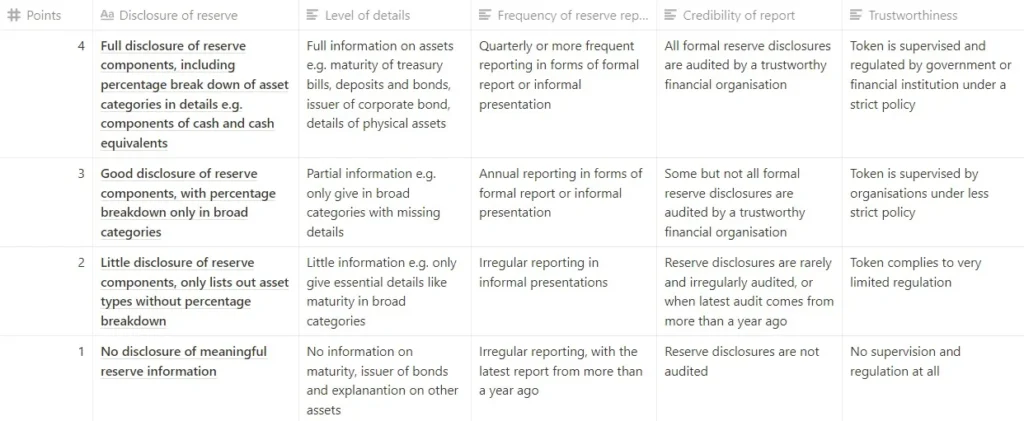

Since information transparency is a relatively qualitative and arbitrary metric, we can use the following matrix that gives a score for each pillar and sums up the scores to reach a ranking evaluation.

Table 1. Transparency ratings matrix

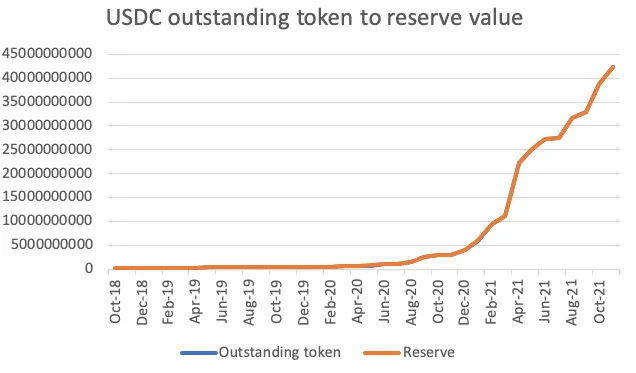

We can then give each protocol a rating on reserve disclosure transparency by summing up points from the five categories, and grouping them into the respective ranking. Protocols with higher scores have better transparency, and hence less financial risk exposure.

Table 2. Transparency ratings scores

According to this evaluation system, protocols with less financial risk exposure should give out detailed information on their reserve, including the proportion, maturity and credit ratings of each asset. These information should also be released on a frequent and regular basis, and audited by trustworthy financial institutions. Lastly, tokens that are regulated under stricter regulations are likely to comply with a specific set of disclosure requirements, which helps to ensure information transparency over a long term.

Example of analysis using USDC

To better understand financial risk exposure analysis from the two perspectives, we will walk an example of USDC, which represents an off-chain stablecoin with low financial risk exposure from reserves.

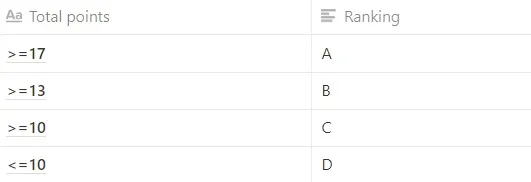

From the latest financial report, as of 31st Dec 2021, USDC holds a highly liquid reserve that is 100% made up of cash and cash equivalents. The cash equivalents portion, although no further details are disclosed, is made up of short term government obligations.

Fig 1. USDC reserve component

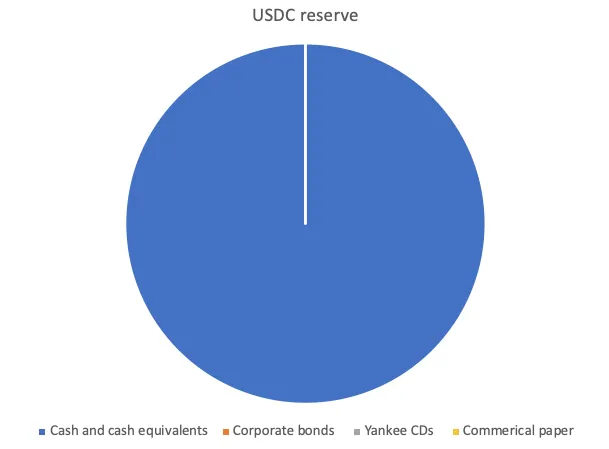

Meanwhile, USDC has consistently maintained a stable 1:1 ratio of outstanding to fair value of reserve. This indicates that all circulating USDC tokens are backed by reserve of equivalent value, hence a high quality of reserve.

Fig 2. USDC outstanding token to reserve value ratio

For level of information transparency, USDC has also performed relatively well. It gives good disclosure of reserve components, but little details on individual asset classes. Information is released in a regular monthly basis in the form of a Reserve Account Report, which is audited by a trustworthy accounting company Grant Thornton LLP. Reserve assets are held by regulated and audited US financial institutions, and the protocol itself is fully regulated under 46 state regulators. According to the evaluation matrix, USDC receives scores of 3, 2, 4, 4, 4, adding up to 17 and A ranking in transparency.

Together with a high quality of reserve comprising of highly liquid assets and high disclosure transparency, we can conclude that USDC has a low level of financial risk exposure from its off-chain reserve.

Conclusion

This article provides a potential method for analysing the financial risk exposure of stablecoins. Similar to other traditional financial assets, risk analysis is a complex problem and we have yet to come to a commonly accepted ranking standard. But by breaking down the components of risk exposure from various sources, we can get a clearer picture of the general risk level. This would be especially useful when we conduct protocol comparisons and cross analysis of the market.