DeFi version of Traditional Finance (TradFi)

Welcome, premium subscribers! Thank you for subscribing. I appreciate you very much.

Shout out to new subscribers: Kally, Drew, Jerome, j88888co, Saagar, PraveenTLDR below. This is not financial advice.

General Conclusion

Finance is complex. If you ask someone what they do, and they say finance, you rarely follow up with “which area in finance?”. Whereas in medicine, you would be more likely to ask about the specialisation like gynaecology, pediatrician, cardiothoracic surgeon.

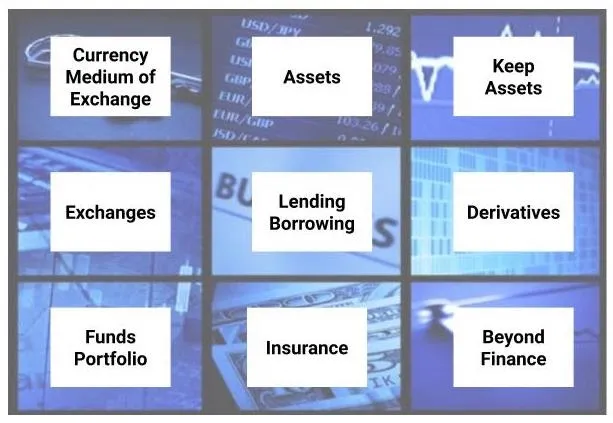

This is because finance is hard and complicated. You have so many sectors and it’s more difficult to keep up with them. There are many sectors in finance, but here specifically, we will dive into 9 sectors. It gives us enough sectors to have a snapshot of the DeFi environment and understand how they work, according to what we have learnt so far.

The 9 sectors we want to look at are currency as a medium of exchange, assets, places to keep these assets, exchanges, lending and borrowing, derivatives, funds and portfolio, insurance and application beyond finance.

1. Currency as a Medium of Exchange

Traditional finance’s medium of exchange includes examples like USD, GBP, EUR, JYP, RMB.

These are governed by 12 very brilliant monetary economists in the central bank. They decide the interest rates, define the inflation rates and printing money.

The purpose of the central bank is to ensure price stability and general trust in the currency.

Remember that in DeFi, we can codify the business logic with machines and math? What if we can define price stability with math to reduce the political influence that makes money non-neutral. Being built on a distributed ledger, it’s possible to outsource trust of the currency to machines and code.

In DeFi, we look at currency as a medium of exchange. A way to get access into the various DeFi sectors (aka protocols).

DeFi’s medium of exchange are currencies such as ETH*, wBTC, USDT, AMPL.

*There is a huge debate on whether ETH is considered a currency. In this specific example of currency as a medium of exchange, ETH is a currency. It is used to exchange between data from DAPP and the Layer 1 transaction validation on Ethereum. The other currencies are medium of exchanges for user-to-user exchange of information and data. Whereas Ether is a medium of exchange for protocol-to-protocol exchange of information and data.

2. Assets

In traditional finance, the existing asset classes are

-

Stock/equity

-

Bond/fixed-income investments

-

Cash/money market funds

-

Real estate/tangible assets

-

Futures and financial derivatives

In DeFi, a new asset class is created. Crypto-assets like SNX, LEND, YFI, MKR could behave somewhat similarly to some types of existing asset classes, but they are unique on their own.

You could have equivalent tokenised versions of the existing asset classes. And a new addition of asset class will also be created in the foreseeable future, as we see how the design of this new asset class plays out.

3. Keep Assets

Now that we have defined the various assets available, where do you keep them?

Assets are kept traditionally in banks like Bank of America, HSBC, Standard Chartered.

There is also a huge movement by fintech NEO banks such as Monzo and Revolut to provide solutions to keep your assets.

In DeFi, assets are kept in crypto-wallets like My Ether Wallet, Metamask, Ledger, Trezor.

4. Exchanges/Trade

Exchanges in traditional finance are NASDQA, the London Stock Exchange, the New York Stock Exchange, and Shanghai Stock Exchange. These systems are basically an order book. Here, buyers and sellers place their orders. The trade can be matched when they find the right counterparty or a market maker comes in to fulfill the order.

For example, I can only sell my cement for steel when there is someone wanting steel for cement (counterparty pairing). Otherwise, a construction company with lots of cement and steel can come in to trade with me (trade via a market maker contract).

In DeFi, there are decentralised exchanges (DEXs) like Uniswap, Bancor, Curve. Instead of pairing with counterparty traders, the machine will execute the trade. To do this, a liquidity pool is introduced and the math is executed by the smart control for the amount to be exchanged. The liquidity pool can be known as the market maker in traditional finance.

5. Lending/Borrowing

People can lend and borrow from traditional banks like Citibank and HSBC, or fintech banks like Monzo. In DeFi, there are lending protocols such as Aave, Maker, Compound.

Adam has extra $100. Benny wants to borrow $100. Now, they do not know each other, so the bank does the trade. Adam puts that $100 in HSBC and the bank pays Adam 1% to safeguard the money.

In turn, the bank will tell Benny, “you need $100 right? I have that $100. I’m going to lend it to you and charge you 5%”. Benny takes the deal and the bank earns 4%.

Now, we can use machines and lending protocols to replace the role of the bank. The lending protocol will define the interest rates via the market demand and provide the option to Benny. Benny can go to Aave, Maker or Compound to view the rates. The one with the best rates will be borrowed by Benny. And Adam puts his $100 in the lending protocol and wait for trade to happen.

Instead of a bank, we now optimise the business logic with math and code in DeFi’s lending and borrowing.

6. Derivatives

Futures contract, forward contract, interest rate swaps, options, structured notes, and variance swaps are some examples of derivatives in traditional finance. The derivatives market is the largest in when it comes to the total value in the entire financial sector. The notional value is 48 times larger than the gross market value.

In DeFi, derivatives are still new and being explored. Marketplaces like Synthetix, Opyn, Hegic, FTX, UMA provide some products in the space. Common crypto derivatives are futures, perpetual futures, options, binary options and variance swaps.

While they are mainly focused on BTC exposure, new products are coming out to also bet on DeFi tokens. New products are coming out like crypto-ETF and DeFi-indexes.

Math is used to define the business logic in simple logic like rebalancing the portfolio and managing a leveraged position.

7. Funds and Portfolios

Exchange-traded funds, mutual funds, hedge funds, and municipal funds are some examples in traditional finance. Funds can be actively managed or passively managed either by companies like Fidelity or asset management companies. There are also venture capital funds for other types of risk exposures.

In DeFi, funds and portfolios can be managed traditionally like via a VC fund or DeFi asset management fund. Alternatively, it can be automated with code and math to allow for trade of the basket of goods or specific assets. For example, there’s PieDAO and Balancer.

This is different from indexes, which is another sector that we are not covering. However, the mechanism is similar, in that they use math to define the allocation proportion in the indexes.

8. Insurance

There are traditional institutions that provide insurance like AIG, AXA, Ping An, AVIVA, Prudential.

Traditionally, insurance started as a peer-to-peer hedge. Farmers pool money together to insure each other. If Lisa’s crops are destroyed due to fire, Lisa can take the pooled insurance fund to cover the losses. In return, Lisa has to contribute monthly to the pooled fund.

As globalisation happens and it becomes challenging to manage the pooled insurance fund and define the risks. Insurance companies come in to aggregate the risk and undertake the risk. In return, people pay a premium to be transferring the risk to the insurance company.

In the DeFi space, insurance is still relatively new and has a huge potential. Payouts can be automated with math and code. Risks can be calculated, given the inputs available with onchain and offchain data.

Nexus Mutual provides financial insurance for smart contract errors in the DeFi space. Opyn provides insurance in a way where you purchase an option contract to hedge your exposure risk.

9. Beyond Finance

Beyond the finance sector, we use financial products in many ways. Like using money to purchase items, in our day to day lives or to settle accounting issues like balance of payment between nations.

In DeFi right now, the market is still very new. The use of DeFi beyond finance is in arts via NFTs and betting markets. Some examples of NFTs include Aavegotchi, Rarebits, Superrare and community access tokens. There’s also Augur, and Gnosis for betting markets.

TLDR:

DeFi is changing traditional finance in the way where we automate various base layer of the technology and remove intermediaries. This is important in Web 3.0. Currently, we are affecting the low hanging fruits like exchanges and lending. More is to come.

Get smart: DeFi is just starting.

Get smarter: The reason why we want to focus so much on open-source base layer innovation is because in Web 3.0, whoever owns these base layer tech can rule the world. That is why open-source and decentralisation is at the heart of DeFi. This is step 1 to creating a more equal future society.