Economics Design

Disclaimer: This is not financial advice

An important source to look at when studying a DeFi protocol is its transaction data. By looking for trends in various factors like transaction volume, number of transactions and size of each transaction, we can formulate a clearer picture of the behaviours of token holders, especially regarding how they use the tokens under different situations. In this analysis, our goal is to discover if there is any trend in transactions that is shown by Gini coefficients.

What is the Gini Coefficient

Traditionally, the Gini coefficient is a measure of income distribution across a population. It is a scale between 0 and 1. A higher Gini coefficient indicates greater inequality which means that the group with a higher income receives a much larger percentage of the total income of the population.

How are we using the Gini Coefficient in DeFi

In the DeFi context we change this definition slightly and use it to show the distribution in size of daily transactions.

We are interested in using the Gini coefficient to test the following:

-

Is there any significant change in transactions between the various days or periods? i.e. are there days in which whales are more active?

-

Are there any significant changes intraday? i.e. Asia market is a more active MKR trader VS US market

-

Are there any interesting outliers or patterns that we can see?

Methodology

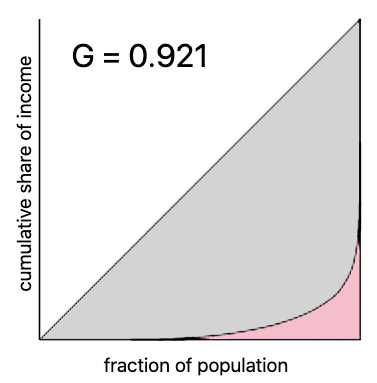

The data used for this analysis comes from scanned results on MKR transactions from Etherscan from 8th June to 16th June. The Gini coefficient is calculated as the ratio of area above the Lorenz curve (coloured in grey) and area below the 45-degrees perfect equality line (sum of grey and pink).

For this entire time frame, the Gini coefficient is 0.921, indicating a very high degree of inequality in transaction sizes where the transactions with a high value take up a much larger proportion of the aggregate transaction value across this period.

Fig 1. Gini coefficient and the Lorenz curve of transactions

Results

Hypothesis #1

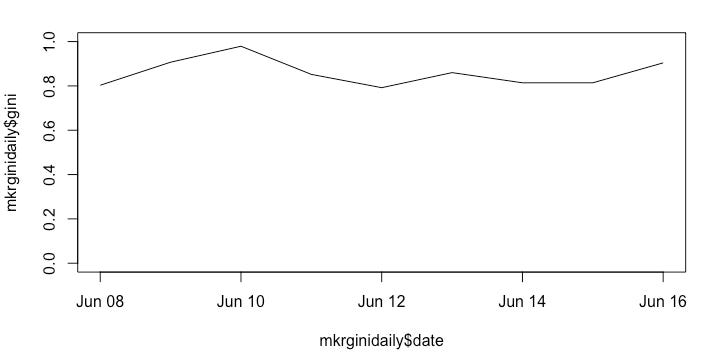

The value of daily Gini coefficients on MKR transactions appears to be stable, ranging from 0.792 to 0.979 with no significant increases or decreases between two consecutive days.

Fig 2. Daily Gini coefficients

Hypothesis #2

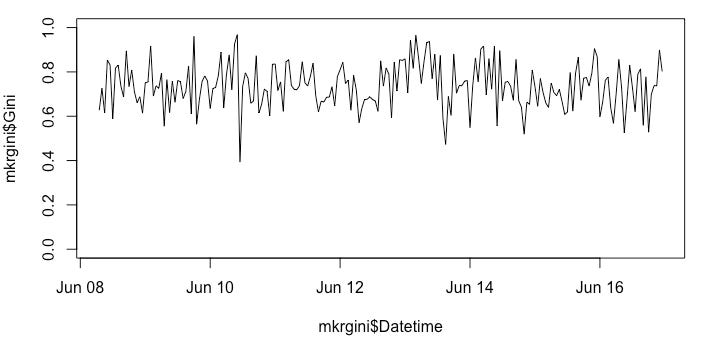

Next, we break down the transaction data further into hourly blocks, and find the Gini coefficient for each hour. The changes in coefficients seem to be more volatile here as shown by the occasional spikes. An interesting observance here is that the Gini coefficients are always changing – they do not stay at a high or low value for multiple hours in a row. Instead, if the coefficient grows for one hour, it is likely to decrease in the next hour.

Fig 3. Hourly Gini coefficients

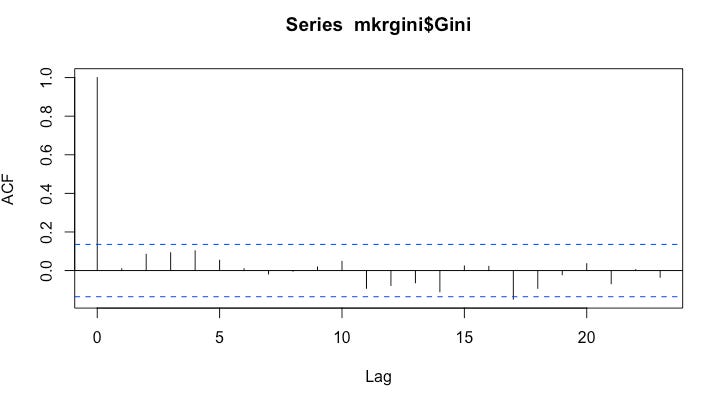

Our initial hypothesis is that there could be some relationships between real world time and the coefficients, as transaction behaviours could be related to which countries are awake at each time. However, the above chart presents a rather random trend that is not related to time. This observation is strengthened by the auto-correlation graph on the hourly Gini coefficients. The ACF cuts off at 0, meaning that there is no time lag in values, so the Gini coefficient in one hour does not affect the Gini coefficient in the next hour.

Fig 4. ACF of Gini coefficients

Hypothesis #3

So if there is no significant relationship between Gini coefficient and time, what other possible factors can be affecting the observed trends in trading behaviours? Some possible answers here include the most dominant reason for token transactions in that period, or the existence of exceptionally large transactions.

The daily Gini coefficient is the highest at 0.979 on 10th June. Upon a closer look at the transaction data, there are 4 very large transactions with more than 5000 MKR traded on that day, which is significantly higher than the average amount of 7.8 MKR from the other transactions in the same day. The largest one is a 21556.52 MKR transaction sent out from the address for MakerDAO, DSChief, Voting, Governance Contract, Maker. Meanwhile, the day with the lowest Gini coefficient falls on 12th June with a value of 0.792. The transaction data for this day appears to be much more evenly distributed, with a large proportion of smaller transactions of 0.0012MKR being sent to the same address 0x95a9bd206ae52c4ba8eecfc93d18eacdd41c88cc.

This shows that the Gini coefficient could be affected significantly by the existence of extremely large transactions that take up an disproportional amount of all transaction volume. This also highlights a limitation of using the Gini coefficient to analyse transactional behaviours, as the coefficient can easily be affected by a single large transaction, yet we should not exclude such transactions as they do happen occasionally and constitute a part of normal operation of tokens.