Market Volatility and Implied Volatility.

Welcome, premium subscribers! Thank you for subscribing.

TLDR below. This is not financial advice.

Catch the episode on YouTube

General Conclusion

2 types of volatility — external volatility (aka market) and implied volatility (aka internal). They are useful factors when understanding your assets.

FactorsBeyond Volatility

Volatility is not the only thing you should care about when looking at your (crypto) assets. Also note the other data and factors.

-

Micro Economy: Inflation of assets

-

Macro Ecosystem: Market Conditions. Market could change and that affects the assets.

-

Past Data: Beyond micro and macro markets it’s also good to look at historical data to look at past data to get some reference and understanding. Note: Past data does not define future performance

Historical Volatility vs Implied Volatility

There are two types of volatility. One is the market volatility and the other is implied volatility. In a very simple way it’s basically historical volatility and future volatility.

Historical volatility: It is based on past data and on all the information that is already given.

Future volatility: It is based on people’s expectations of the assets and here you calculate based on how people pay for the expected assets.

Higher Volatility = Higher Risk

The general notion about volatility is that higher volatility = high risk.

Sometimes it is called educated gambling or educated speculation but it’s not always true. The general notion of higher volatility means that the price will move more and when the prices move more, higher risk will be experienced. But it really depends on the trading strategy because that will help to mitigate different risks as when you have something with high volatility you can do something else to try and offset the risk or try to reduce that risk.

What is Market Volatility?

It’s a statistical measure of how “spread” is the value from the middle average. More spread (like a pancake) means higher volatility. Less spread (like a mountain) means lower volatilty.

-

Uses Past Data: It’s historical volatility or using past data to get some understanding of where the asset is right now.

-

Fluctuation of Returns: It is the fluctuation (movement) of the returns of the prices of the assets. It is measured by measuring the spread of the returns so you can think of it as two bell curves. One bell curve is flat so almost like a very low middle line and it spreads out very widely like a pancake. You have another bell curve like the Mount Everest so it has a very high peak and everything is very narrow towards the peak.

-

Higher Volatility: Volatility is the spread of the value of the assets so when it’s more pancake shape (i.e. when the sides are more spread out into different directions) that’s where it’s more volatile. Because there are more ways the spread could go.

Whereas if it’s higher like a mountain (i.e. when it’s very narrow towards the center ), then there is low volatility because the prices won’t change so much and it’s all within a very constrained range.

(ELI5) How to Read Charts: High vs Low Volatility

This chart is about the prices of bitcoin in the past 180 days.

-

In July, The price moved very little and always hovered below 10,000.

-

In the august period it moved quite a bit but the candle charts didn’t move as significantly as earlier.

-

From September to mid-October it also moved a bit which can be seen in the candle chart.

-

In November, December and January, huge movement or huge candle charts can be seen. Which tells us how volatile the asset is relative to the entire the asset in the long run.

Volatility is really just comparison and you can’t say something is volatile without comparing it to something else.

It can either be compared to its past data or some other asset or benchmark. So let’s say we compare bitcoin six months ago to bitcoin today:

Six months ago was low volatility and right now it’s high volatility because prices change so much which can be seen in the candle chart. That is comparing the asset to itself.

Now let’s look at comparing the asset to another asset or another benchmark. That would be the other chart which is the pancake-shaped bell curve versus the mountain-shaped bell curve.

The pancake-shaped bell curve is where it’s higher volatility because prices can spread out a bit more and the spread is much wider versus the mountain-shaped which is low volatility and the shape is going more towards the middle line.

Why do we care?

These values give us two main information:

-

Market sentiment: It ****is something like the better volatility where we try to figure out what the market is thinking about and how it compares to other assets

-

Historical spot price: It is how the asset itself is doing

We use the information to make bets with it or to hedge against the future

What is Implied Volatility

Implied volatility is the predicted or future volatility that the market is expecting. This is quite different from the historical or market volatility as the market one uses historical data to calculate the value of volatility. Whereas implicit volatility uses the expected value of the options contract and the fluctuation in the expected returns via options contract i.e. how much people are willing to pay for it translates to how people expect volatility to be in the future and Implied volatility measures spread of expected returns.

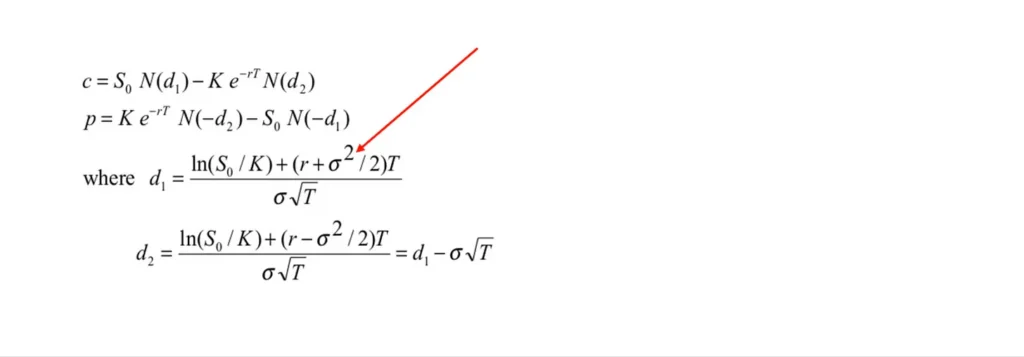

The Black-Scholes Formulas

Measuring Implied Volatility (IV)

No formula can be used to calculate implicit volatility and the value is calculated through options contract. Let’s say the market thinks that the future will be very uncertain (huge volatility) so the people would be paying more for the call and put options because they want to hedge or lock in their prices before market volatility and uncertainty comes in so higher option prices reflect higher implicit volatility in the future.

Valuing IV

The way we value implicit volatility is by using something else as a proxy to calculate it backwards so as to find the value of it.

Tthe economic value of implicit volatility is the value that exists in the option contract and the price to option is a lot more than just the implicit volatility as it includes three other main variables. Implicit volatility is just one of them.

However for implicit volatility there is a value that exists within the contract itself that continues to be there until the options expire because it allows you to lock in the price of a specific asset.

Speculate/Bet on Volatility Movement

The other way is to speculate or bet on volatility movement. Let’s say that I think prices are going to fall a lot and I think it’s going to be super volatile and I want to speculate on that and so I can either speculate a short position or a long position.

For example, if I’m a seller of Bitcoin and I think maybe it’s going to rise to 45k by the end of Q1. Since I want to make profits out of it, maybe I can go to one of these options contract and ask them if I can buy bitcoins from them at 44k and execute it within next three months and pay a certain amount of money to them for this opportunity

If the price hits 45k within this 3 months period, I get to purchase it at 44k and sell it immediately in the secondary market and earn 1k in profits (before cost of options contract).

When do we see High Volatility?

Let’s say as a buyer I’m super worried about the future and don’t really know what the future is going to be as it’s super uncertain.

I want an option or a possibility to lock in the prices right now. So if everyone thinks like me and everyone is very worried about how uncertain the market is going, to be then we all want to get an options contract and lock in the prices right now.

On the other hand, sellers also realize that it’s quite uncertain in the future and maybe expect that the future prices will change/increase drastically and want to lock in the profits right now as well and so if someone wants to purchase the assets at a specific price right now, then the sellers are going to ask for a higher price because they think that they can sell it for a better price in the future.

When the demand increases because option buyers want to lock in their price then demand curve shifts and the equilibrium and option prices increase.

TLDR: too volatile and uncertain. Buyers want to lock in prices now and demand more options contract.

When do we see Low Volatility?

This happens when option buyers pay less for it because maybe the market is doing very good and it’s low volatility.

In that case, not many people are wanting to purchase options because the market is so stable anyway and option sellers also know that there’s nothing much for them. Hence, there isn’t much demand for it and there aren’t many suppliers wanting to sell it because nobody’s demanding anyway. Option prices decrease and we can see that in having a smaller price movement or smaller expected price movement in the future and it makes sense because people don’t want to spend money to hedge against something when everything is super stable.

TLDR: market is relatively stable and you don’t need to get an options contract to hedge or bet. Price movement is low. Don’t spend money on buying options contracts.

Ways to hedge Volatility

Futures Contract

A futures contract is when you lock in the future prices and you have to purchase it so you can either get it physically delivered or cash-settled but once you sign in a futures contract you lock in their future prices which can’t be changed and there is a 100% obligation to purchase it. This is one way to hedge against volatility and it is used by airline companies where oil markets are super volatile so they have futures contracts with oil drakes or with banks to lock in the oil prices which will then determine the cost of operating an airlines company and the price of tickets.

Swapping

There are a lot of different types of swaps like currency swaps, commodity swaps, interest rate swaps, and credit default swaps. Swaps are just another way of addressing volatility and instead of having variable interest rates or variable values you have a swap to get a fixed value or fixed interest rate so this is another way to hedge against volatility.

It is a very complicated topic but in general, just think of it as swapping my risk or volatility with something else so I do something else instead to reduce my risk of volatility and I still have to pay for it but it does reduce volatility and whatever happens in the market I am somewhat more protected.

Options

You can just use very simple options to hedge against something like price increase or decrease or you can be an option buyer or seller so for example, if you think that prices are going to rise too much or fall too much then you can find ways to sell or buy depending on what your strategy is with the different options and the second way is insurance against price movements so if it rises by too much and you’re a bit worried then you can get an option to give you the right to buy at a lower price provided there’s someone willing to sell to you at the lower price and you pay money for that right then you can also speculate on prices increasing or decreasing and lastly you can help to reduce exposure or risk.

Using Options in Crypto Finance

CeFi

In CeFi we have OTC which is Ledger X and usually, OTC is more expensive but you get to customize it a little bit more and then you have other things like CME, Bakkt, FTX, and Deribit which are exchanges where they have somewhat a standardized options contract which can be traded on exchanges.

DeFi

It’s a bit more complicated because you have a token involved and usually the whole market maker and market taker thing is a bit different so think of it as AMM plus options adding together and sometimes you want to add other derivatives in there so this is where DeFi really differs from CeFi

Listen on podcast if you prefer audio version.

TLDR:

Option contracts are a way to hedge against volatility (price movement) in the market. Other ways include a futures contract and swapping.

In general, higher volatility means higher risk because prices move more. That affects people’s demand for option prices. Form options contracts, we can also tell how bullish or bearish the market is.

Get smart: Options are a tool that can be used to hedge against risks or to bet in the market. The difficult tool, but powerful when used right.

Get smarter: CeFi options for crypto exists. And DeFi options protocols are coming right up.

Order the book now: book.economicsdesign.com