The Graph.

Welcome, premium subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers.

Please keep these mails secret and do not share them with any one because these alphas are confidential. Enjoy your reading.TLDR below. This is not financial advice.

General Conclusion

The Graph is seen as the Google of crypto, helping users to query information similar to how we often do in real life. In this article we will learn about three main parts:

-

What is The Graph, what is the idea and product of the project?

-

The relevant information about the main token of the project which is $GRT.

-

Finally, we will combine the above factors to provide an overview of the robustness of the $GRT economics model.

What Is The Graph?

The internet is a big place. When you need to search for something, you need a directory. That directory is Google. Blockchain is also a big place. When you need some information, you need a directory. That directory is The Graph.

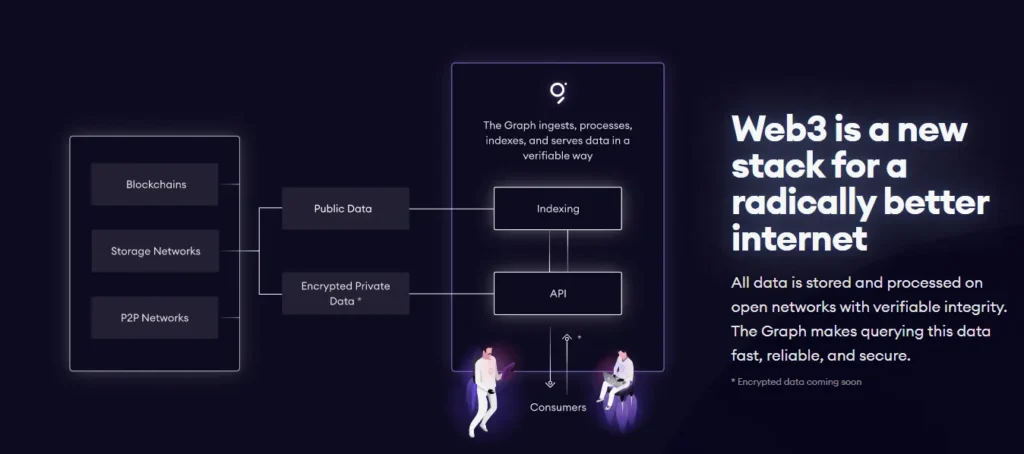

The Graph is a protocol that allows indexing and querying of data from the blockchain. The Graph allows anyone to build and publish APIs called subgraphs. Subgraphs makes it easier to access data from blockchain.

Currently, The Graph supports many blockchains such as Ethereum, Polkadot, Near, Fantom, Solana, Celo, etc., and even layer 2 of Ethereum such as Polygon, Arbitrum, Optimism, etc.

What Problem Does The Graph Solve?

From the user’s perspective, they almost don’t care much about whether the application is decentralised or centralised. What they really care about is which one is smoother, faster and cheaper.

If the app doesn’t meet this, it will gradually be eliminated by other protocols that do better. One of the main problems is accessing data directly from blockchains.

Data output from the blockchain is rarely stored in a format that can be used directly in dapps (decentralised applications). It needs sorting, sorting, and reprocessing so that dapps can process more easily and smoothly.

Looking at how it works, it can be said that Graph is solving a huge problem of data provided for dapp applications on the Web 3.0 platform. The Graph can be considered as a gateway to enter Web3.

What Is The Graph’s Solution?

The Graph’s solution is to build a protocol that anyone can access to build and publish APIs called subgraphs. Subgraphs makes it easier to access data from blockchain.

All data is encrypted, stored and processed on-chain with verifiable integrity. Through its API, The Graph makes querying these data fast, reliable and secure.

The Graph Structure

The Graph ecosystem will include the following components:

-

Indexers: Node creators in The Graph network. Indexers will stake $GRT to provide an indexing and query processing service. Indexers earn query fees and inflation rewards, they will compete with each other to provide the best service at the lowest price.

-

Curators: Subgraph developers. They sort the data and signaling subgraphs which are useful and accurate. Curators can earn $GRT through this process.

-

Delegators: These are people who want to get involved in securing The Graph network but they may not want to or do not have the coding expertise to become curators or indexers. Delegators can delegate their $GRT to indexers to share rewards.

-

Consumers: The Graph’s end users. They use the data query service provided by indexers. The fee is shared proportionally between indexers, curators, delegators. Consumers can be other developers or projects that want to query data from the blockchain for their applications, like the cost of AWS or a cloud service.

What Is Graph Token?

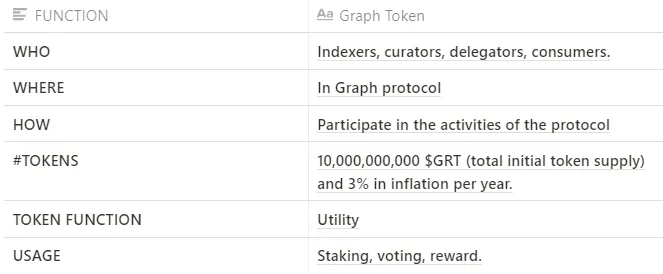

$GRT is the native token of The Graph ecosystem. There is a total of 10B $GRT and they are used for the following purposes:

-

Query fee: The fee consumers pay to indexers, curators, and delegators.

-

Network inflation reward: shared between indexers, curators and delegators based on their $GRT stake.

-

Protocol sinks & burns: part of the query fee burned, expected to start at ~1% of the total protocol query fee and subject to change in the future.

Economics Design

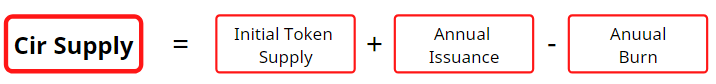

The Graph does not have a maximum total token supply.

The original 10B $GRT was minted. There are both inflationary and deflationary mechanisms defined in the protocol.

Token Policy

Possible inflation through the annual release of new tokens is set at around 3% in the first year. That number is reviewed periodically through engineering administration and can go as low as 0%. Deflation occurs as part of ongoing protocol activity by network members through various deposit taxes and potential governance cuts. The average annual burn rate is expected to be around 1%.

While the net change in token supply is therefore expected to be +2% in the first year, future levels of change are subject to change and also a slight deflation if the issuance annually for a specified period set to 0%.

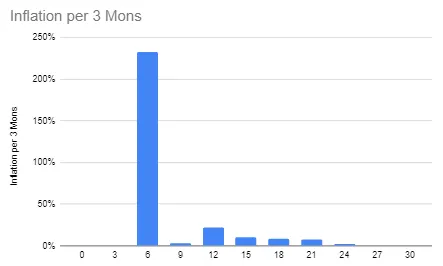

According to the token release schedule information, by the end of the 6th month, a large amount of $GRT will be unlocked (about 30% in total initial token supply). This creates a 233% increase over the previous 3 months.

It is expected that in the first year, more than 5.3B (53% in initial token supply) $GRT will be unlocked, equivalent to an annual inflation rate of 322%. This is a huge sell pressure if the project doesn’t grow quickly.

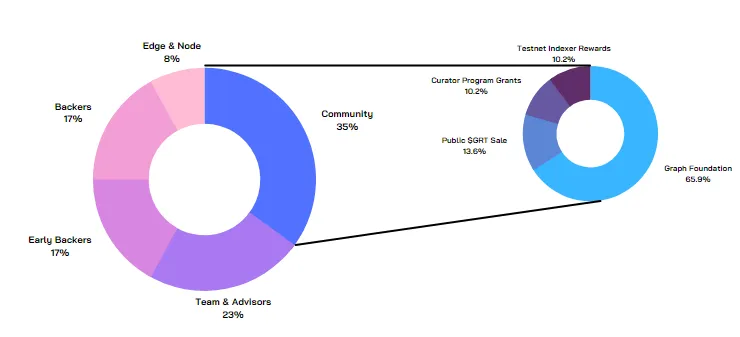

Token Allocation

Thoughts and Opinions

The Graph can be a very powerful infrastructure in the blockchain space. The tool on its own is great. $GRT is also not just a payment tool, as that would increase friction of payments. $GRT’s use-case in the protocol makes sense.

The token is used as an incentive to allow for users to use the protocol. Its allocation, however, can be better improved to reward the right users of the system instead of the asymmetric returns to the foundation, team and early investors.

TLDR:

Dubbed the Google of blockchain, The Graph is really contributing to a revolutionary change as they solve the problems of data. With their solution, data on blockchain will be more systematic, easy to query and bring convenience to users.

The Graph is supporting multi-blockchain scaling, testing subgraphs on the framework, optimizing Blockchain L1, developing programs with educational content and much more in the future.